|

|

Less-than-Container-Load | Affordable International Shipping | 7-Step Guide

Shipping Goods to Latvia from the USA

Latvia Import Regulations: A Complete Guide for U.S. Shippers

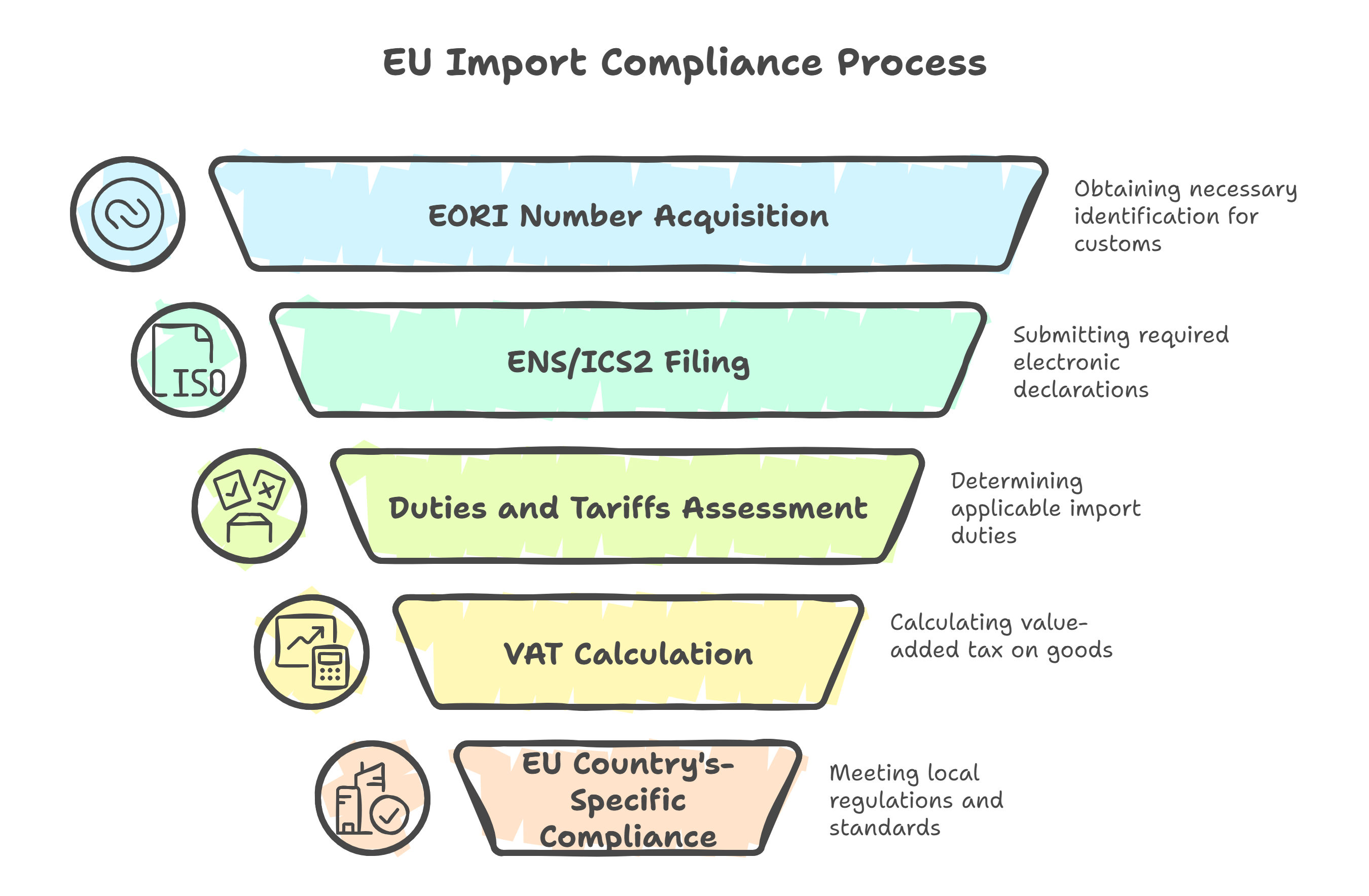

Latvia, a member of the European Union and the Schengen Area, is a growing logistics gateway to Northern and Eastern Europe. Whether you're relocating or exporting products, understanding Latvia’s import procedures will help ensure a smooth shipping experience from the USA and help manage international shipping costs efficiently.

This guide outlines the customs procedures, documentation, tax exemptions, and how a professional international shipping company can help provide fast and affordable shipping to Latvia.

Key Facts About Importing to Latvia

Latvia adheres to EU customs laws and VAT regulations.

Goods shipped from the U.S. are subject to customs duties, Value Added Tax (VAT), and potential excise taxes.

Businesses must obtain an Economic Operator Registration and Identification (EORI) number to import goods.

Individuals relocating to Latvia may be eligible for duty-free importation of household goods.

Partnering with a skilled international shipping company ensures compliance, cost control, and efficient logistics.

Step-by-Step: How to Import to Latvia

1. Register for an EORI Number (For Business Imports)

An EORI (Economic Operators Registration and Identification) number is mandatory for all EU business imports.

Individuals shipping personal goods do not need an EORI.

2. Required Documentation

To clear goods through Latvian customs, you’ll need:

- Bill of Lading (BOL) or Air Waybill

- Commercial invoice (listing goods, values, HS codes, and origin)

- Packing list

- Import declaration (SAD – Single Administrative Document)

- Certificate of Origin (for trade agreement preferences)

- Import licenses (for restricted items)

For personal shipments:

- Passport

- Latvian visa or residence permit

- Proof of residence outside the EU

- Inventory list

- Declaration of non-commercial use

Ensure all documents are consistent with the actual contents to avoid customs delays.

3. Duties, VAT, and Exemptions

#Standard Tax Rates:

- Customs duties: Vary from 0–12%, depending on classification

- VAT: Latvia's standard VAT rate is 21%, calculated on CIF value (Cost + Insurance + Freight) + duty

- Excise duties: Apply to alcohol, tobacco, fuel, and luxury items

#Personal Exemptions:

Individuals relocating to Latvia from outside the EU may import used household goods duty- and VAT-free if:

- You have lived outside the EU for 12+ months

- You're establishing permanent residency in Latvia

- Goods are used and owned for over 6 months

- Shipment arrives within 12 months of your move

- You do not sell the goods within 12 months

A qualified international shipping company can help you file for exemptions and reduce your international shipping cost.

Restricted and Prohibited Items

Restricted Items:

- Medications – Personal use only, with prescriptions

- Food, plants, and animal products – Require certificates

- Alcohol and tobacco – Quantity limits and excise taxes apply

- Firearms – Must be licensed and declared

- Electronics – Must meet EU CE marking standards

Prohibited Items:

- Narcotics and illegal drugs

- Weapons and explosives (unless licensed)

- Counterfeit or pirated goods

- Hazardous waste

- Protected wildlife products under CITES

Shipping Personal Effects to Latvia

If you're relocating to Latvia, you can ship your personal belongings with tax exemptions if you meet the EU relocation criteria. Goods must:

- For personal use only

- Be used and owned for 6+ months

- Be imported within 12 months of arrival

- Remain with you (not sold) for at least 12 months

Required Documents:

- Passport and residence visa

- Proof of previous non-EU residence

- Proof of new Latvian address

- Detailed inventory list

- Customs exemption declaration

Packaging and Labeling Requirements

Goods entering Latvia must meet EU import and labeling standards, including:

- CE marking for electronics, toys, and appliances

- Product labels in Latvian or another EU language

- Ingredient and nutritional details for food

- Safety warnings and usage instructions

- ISPM 15 certification for all wood packaging (pallets, crates)

Who Can Help?

Work With an International Shipping Company

Hiring a professional international shipping company ensures:

- Correct classification of goods using HS codes

- Electronic submission of customs declarations

- Proper paperwork for VAT exemptions and CE compliance

- Safe freight routing and delivery in Latvia

- Flexible, affordable shipping solutions via sea or air

Final Import Checklist for Latvia

| ✅ Requirement | Applies to | Action |

|---|---|---|

| EORI number | Business imports | Required for customs declaration |

| SAD import declaration | All shipments | Must be filed with Latvian Customs |

| VAT (21%) + duty (0–12%) | Most imports | Based on the CIF value |

| CE marking | Electronics, machinery | Mandatory for EU sales and usage |

| ISPM 15 | Wood packaging | Required for crates and pallets |

| Proof of relocation | Personal effects | Needed for exemption from taxes |

Conclusion: Shipping to Latvia from the USA

Latvia offers efficient customs clearance as part of the European Union, but following the correct procedures is crucial to avoid costly errors. Whether you’re relocating or exporting products, a well-planned shipment ensures compliance and cost savings.

A trusted international shipping company can help minimize international shipping costs, manage VAT and documentation, and offer affordable shipping from the USA to Latvia.

.png)