Freight from the USA

|

|

|

|||

Less-than-Container-Load | Affordable International Shipping | 7-Step Guide

Latvia Import Regulations: A Complete Guide for U.S. Shippers

Latvia, a member of the European Union and the Schengen Area, is a growing logistics gateway to Northern and Eastern Europe. Whether you're relocating or exporting products, understanding Latvia’s import procedures will help ensure a smooth shipping experience from the USA and help manage international shipping costs efficiently.

This guide outlines the customs procedures, documentation, tax exemptions, and how a professional international shipping company can help provide fast and affordable shipping to Latvia.

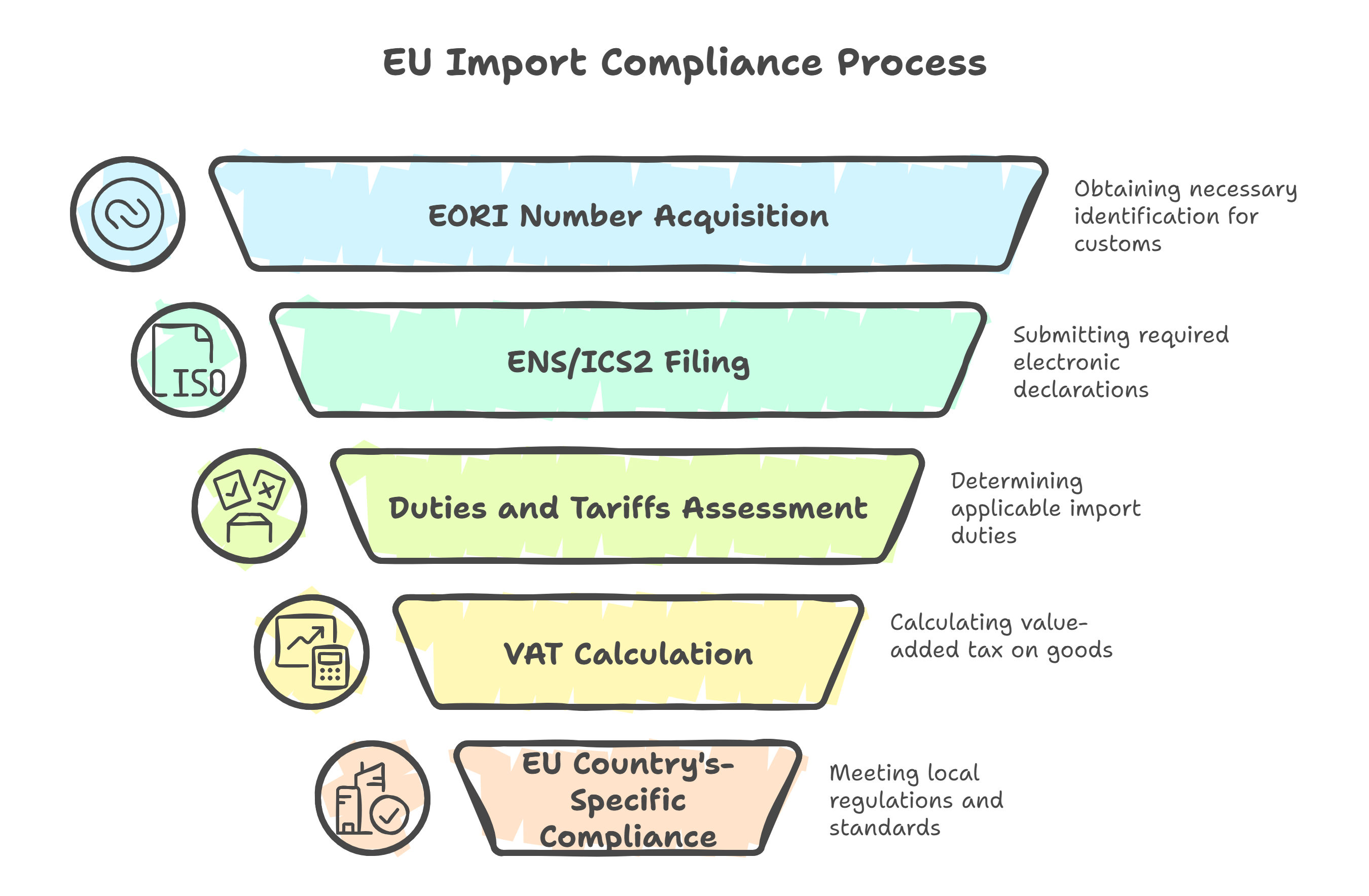

Latvia adheres to EU customs laws and VAT regulations.

Goods shipped from the U.S. are subject to customs duties, Value Added Tax (VAT), and potential excise taxes.

Businesses must obtain an Economic Operator Registration and Identification (EORI) number to import goods.

Individuals relocating to Latvia may be eligible for duty-free importation of household goods.

Partnering with a skilled international shipping company ensures compliance, cost control, and efficient logistics.

An EORI (Economic Operators Registration and Identification) number is mandatory for all EU business imports.

Individuals shipping personal goods do not need an EORI.

To clear goods through Latvian customs, you’ll need:

For personal shipments:

Ensure all documents are consistent with the actual contents to avoid customs delays.

#Standard Tax Rates:

#Personal Exemptions:

Individuals relocating to Latvia from outside the EU may import used household goods duty- and VAT-free if:

A qualified international shipping company can help you file for exemptions and reduce your international shipping cost.

Restricted Items:

Prohibited Items:

If you're relocating to Latvia, you can ship your personal belongings with tax exemptions if you meet the EU relocation criteria. Goods must:

Required Documents:

Goods entering Latvia must meet EU import and labeling standards, including:

Work With an International Shipping Company

Hiring a professional international shipping company ensures:

Final Import Checklist for Latvia

| ✅ Requirement | Applies to | Action |

|---|---|---|

| EORI number | Business imports | Required for customs declaration |

| SAD import declaration | All shipments | Must be filed with Latvian Customs |

| VAT (21%) + duty (0–12%) | Most imports | Based on the CIF value |

| CE marking | Electronics, machinery | Mandatory for EU sales and usage |

| ISPM 15 | Wood packaging | Required for crates and pallets |

| Proof of relocation | Personal effects | Needed for exemption from taxes |

Latvia offers efficient customs clearance as part of the European Union, but following the correct procedures is crucial to avoid costly errors. Whether you’re relocating or exporting products, a well-planned shipment ensures compliance and cost savings.

A trusted international shipping company can help minimize international shipping costs, manage VAT and documentation, and offer affordable shipping from the USA to Latvia.

|

|