|

|

Less-than-Container-Load | Affordable International Shipping | 7-Step Guide

Shipping Goods to Austria from the USA

Austria Import Regulations: A Complete Guide for U.S. Shippers

Austria, centrally located in Europe and part of the EU, is a popular destination for American exports and personal shipments. Whether you're shipping from the USA for business or personal reasons, understanding Austrian import regulations is key to avoiding customs delays and added costs.

This guide covers the steps and requirements for importing into Austria, including taxes, restricted items, documents needed, and how an experienced international shipping company can help reduce your international shipping cost and ensure affordable shipping.

Key Facts About Importing to Austria

Austria is a member of the European Union, adhering to all EU customs regulations.

- All goods from outside the European Union (EU) are subject to customs clearance, duties, and Value-Added Tax (VAT).

- The Austrian Federal Ministry of Finance manages Austrian customs.

- Commercial importers need an EORI number.

- Used household goods may be exempt from duties under relocation rules.

A professional international shipping company ensures compliance and helps estimate your total international shipping cost.

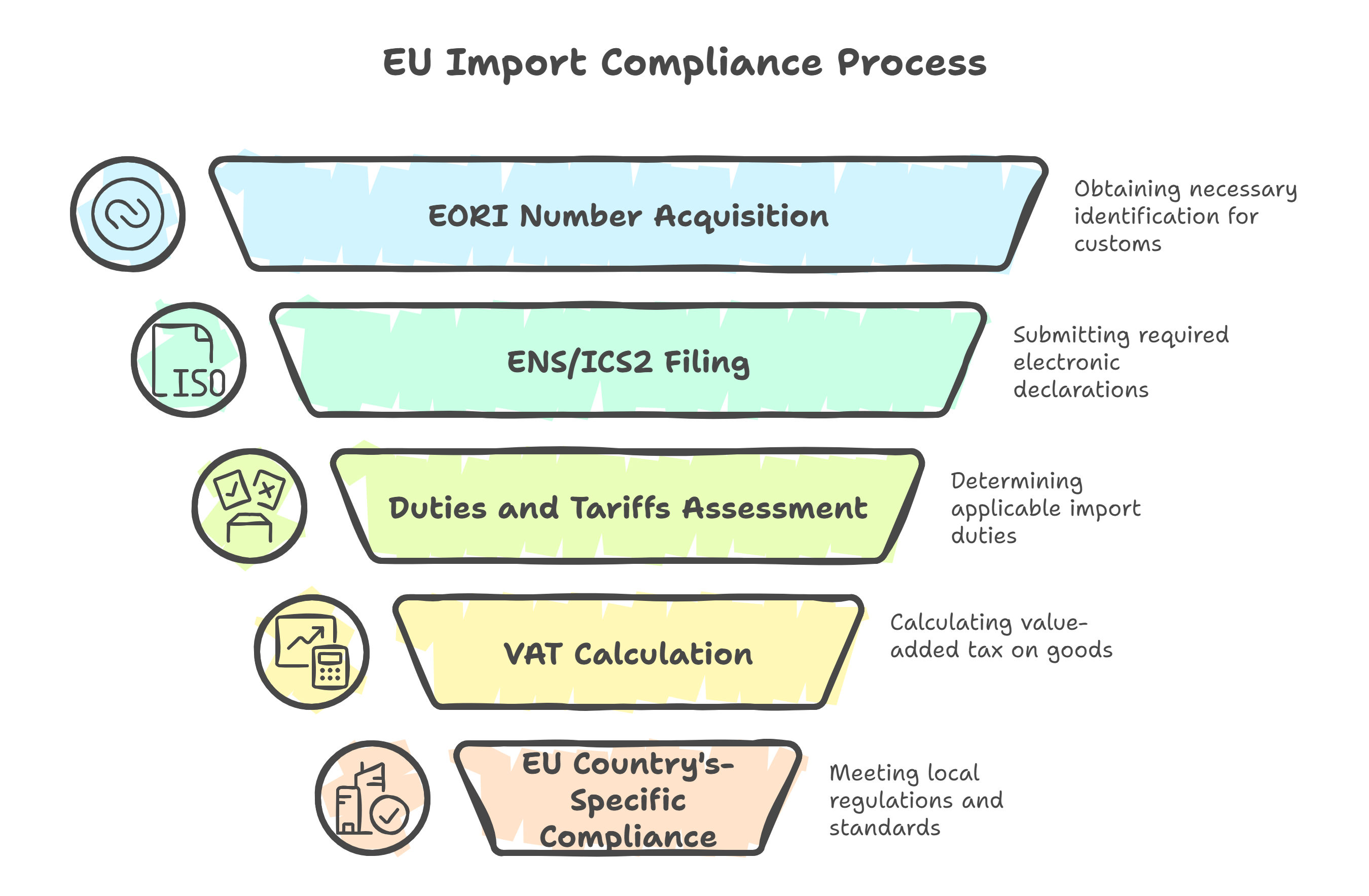

Step-by-Step: How to Import to Austria

1. Obtain an EORI Number (For Commercial Shipments)

Businesses importing to Austria must have a valid EORI (Economic Operators Registration and Identification) number issued by any EU country.

- Required to file customs declarations and track shipments.

- Not needed for private individuals shipping personal items.

2. Prepare the Required Documents

For customs clearance, the following documents are commonly required:

- Bill of Lading (BOL) or Air Waybill

- Commercial invoice with product description and HS codes

- Packing list

- Customs declaration form (SAD – Single Administrative Document)

- Certificate of Origin (if using preferential tariffs)

- Import license (for restricted goods)

For personal effects:

- Passport

- Inventory list

- Proof of change of residence to Austria

- Declaration of non-commercial use

Documents must be accurate; inconsistent details can cause delays or additional fees.

3. Understand Duties, VAT, and Tax-Free Options

When shipping from the USA, the following taxes may apply:

- Customs duties: Based on the EU Common Customs Tariff, typically 0–12%

- VAT: Austria applies a 20% standard VAT, calculated on CIF value + duty

- Excise duties: On items like alcohol, tobacco, and fuel

Used household goods may be imported duty- and VAT-free if:

- The shipper is relocating to Austria

- Items are used, personally owned, and not for resale

- Shipment arrives within 12 months of relocation

An international shipping company can help calculate your estimated international shipping cost and identify applicable exemptions.

4. Restricted and Prohibited Goods

Austria follows EU rules for import restrictions. Commonly regulated items include:

- Pharmaceuticals and supplements – Require EU approval

- Food products – Must meet EU sanitary standards

- Cosmetics and electronics – Subject to CE labeling requirements

- Weapons, ammunition, and fireworks – Heavily restricted or banned

- Animal products and plants – Require phytosanitary or veterinary certificates

Labeling Requirements:

- Labels must be in German

- Must include product name, origin, ingredients, safety warnings, and usage instructions

- Metric units are required for all measurements

- Expiry or manufacture dates for consumables are mandatory

Wood packaging (pallets, crates) must comply with ISPM 15 standards—heat-treated and properly marked.

Shipping Personal Effects to Austria

If you’re moving to Austria, you may qualify for duty- and tax-free import of personal effects.

To Qualify:

- Items must be used and personally owned for at least 6 months

- You are relocating your primary residence to Austria

- Goods arrive within 12 months of your relocation date

Required Documents:

- Passport

- Proof of residency change (rental contract, deregistration from the U.S.)

- Detailed inventory list

- Declaration of non-commercial use

New or unopened goods may be taxed, even in shipments of personal effects.

Packaging & Labeling Requirements

Retail goods must comply with EU packaging and labeling standards:

- Labels must be in German

- Include product description, manufacturer, importer, origin, and CE mark (if applicable)

- Foods and cosmetics must show ingredients and shelf life

- Use the metric system for measurements

- Wooden packaging must be ISPM 15 certified

Non-compliant shipments may be refused or held for inspection.

Who Can Help?

Work with a Licensed Customs Broker or International Shipping Company

A professional international shipping company or an Austrian customs broker can:

- Prepare and submit EU customs declarations

- Assist with EORI registration and product classification

- Advise on exemptions for household goods

- Coordinate delivery within Austria or other EU countries

This guidance ensures affordable shipping and accurate customs clearance, eliminating unexpected costs and delays.

Final Import Checklist for Austria

| ✅ Requirement | Applies to | Action |

|---|---|---|

| EORI number | Commercial shipments | Required for all EU imports |

| SAD customs declaration | All shipments | Must be submitted through the Austrian customs |

| Customs duty (0–12%) | Most products | Based on HS classification |

| VAT (20%) | All goods | Calculated on CIF + duty |

| CE mark and German labeling | Consumer goods | Required for clearance |

| ISPM 15 compliance | Wood packaging | Required for crates and pallets |

| Relocation declaration | Used personal effects | Required for tax exemption |

Conclusion: Shipping to Austria from the USA

Austria’s position within the EU provides a consistent customs process but requires close attention to documentation and labeling. Whether shipping commercial goods or relocating, proper planning is essential.

By partnering with a trusted international shipping company, you can reduce your international shipping costs, avoid delays, and ensure affordable shipping from the U.S. to Austria.

.png)