Freight from the USA

|

|

|

|||

Less-than-Container-Load | Affordable International Shipping | 7-Step Guide

Austria, centrally located in Europe and part of the EU, is a popular destination for American exports and personal shipments. Whether you're shipping from the USA for business or personal reasons, understanding Austrian import regulations is key to avoiding customs delays and added costs.

This guide covers the steps and requirements for importing into Austria, including taxes, restricted items, documents needed, and how an experienced international shipping company can help reduce your international shipping cost and ensure affordable shipping.

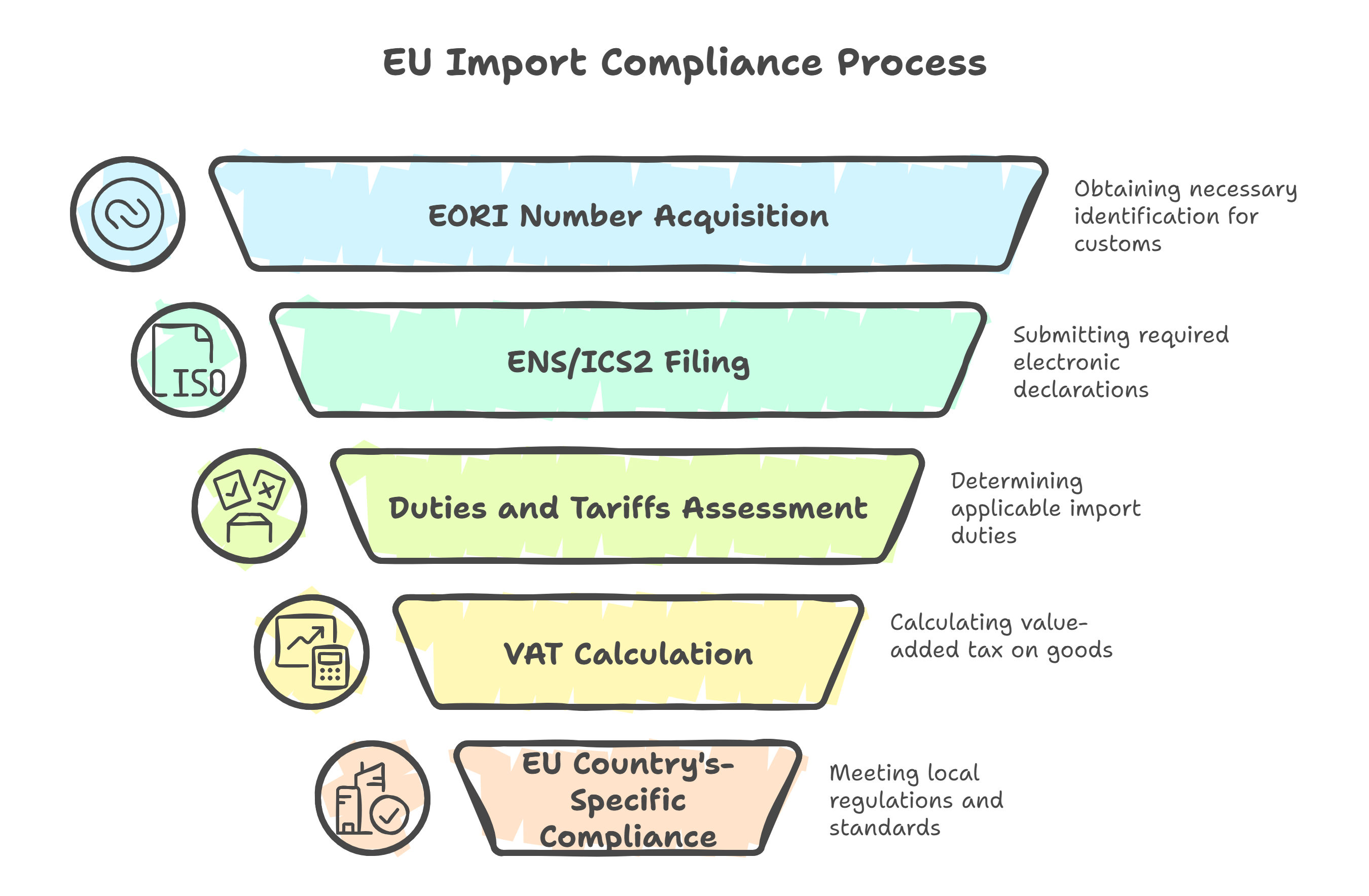

Austria is a member of the European Union, adhering to all EU customs regulations.

A professional international shipping company ensures compliance and helps estimate your total international shipping cost.

Businesses importing to Austria must have a valid EORI (Economic Operators Registration and Identification) number issued by any EU country.

For customs clearance, the following documents are commonly required:

For personal effects:

Documents must be accurate; inconsistent details can cause delays or additional fees.

When shipping from the USA, the following taxes may apply:

Used household goods may be imported duty- and VAT-free if:

An international shipping company can help calculate your estimated international shipping cost and identify applicable exemptions.

Austria follows EU rules for import restrictions. Commonly regulated items include:

Labeling Requirements:

Wood packaging (pallets, crates) must comply with ISPM 15 standards—heat-treated and properly marked.

If you’re moving to Austria, you may qualify for duty- and tax-free import of personal effects.

To Qualify:

Required Documents:

New or unopened goods may be taxed, even in shipments of personal effects.

Retail goods must comply with EU packaging and labeling standards:

Non-compliant shipments may be refused or held for inspection.

Work with a Licensed Customs Broker or International Shipping Company

A professional international shipping company or an Austrian customs broker can:

This guidance ensures affordable shipping and accurate customs clearance, eliminating unexpected costs and delays.

Final Import Checklist for Austria

| ✅ Requirement | Applies to | Action |

|---|---|---|

| EORI number | Commercial shipments | Required for all EU imports |

| SAD customs declaration | All shipments | Must be submitted through the Austrian customs |

| Customs duty (0–12%) | Most products | Based on HS classification |

| VAT (20%) | All goods | Calculated on CIF + duty |

| CE mark and German labeling | Consumer goods | Required for clearance |

| ISPM 15 compliance | Wood packaging | Required for crates and pallets |

| Relocation declaration | Used personal effects | Required for tax exemption |

Austria’s position within the EU provides a consistent customs process but requires close attention to documentation and labeling. Whether shipping commercial goods or relocating, proper planning is essential.

By partnering with a trusted international shipping company, you can reduce your international shipping costs, avoid delays, and ensure affordable shipping from the U.S. to Austria.

|

|