|

|

Less-than-Container-Load | Affordable International Shipping | 7-Step Guide

Shipping to Romania from the USA

Romania Import Regulations: A Complete Guide for U.S. Shippers

Romania, a growing market within the European Union, offers excellent opportunities for both business and personal imports from the United States. Whether you're relocating or sending commercial goods, understanding Romania’s import requirements will help ensure a smooth process and avoid unnecessary costs.

This guide breaks down what U.S. shippers need to know, including documentation, taxes, and how working with a professional international shipping company can lower your international shipping costs and ensure affordable shipping to Romania.

Key Facts About Importing to Romania

Romania is a member of the European Union and adheres to the standard EU customs regulations.

- All non-EU shipments must clear customs and are subject to customs duties, VAT, and possible excise taxes.

- Commercial importers are required to have an Economic Operator Registration and Identification (EORI) number.

- Personal effects used may qualify for tax exemption under relocation rules.

A licensed international shipping company will help ensure all requirements are met, minimizing errors and delays while keeping international shipping costs in check.

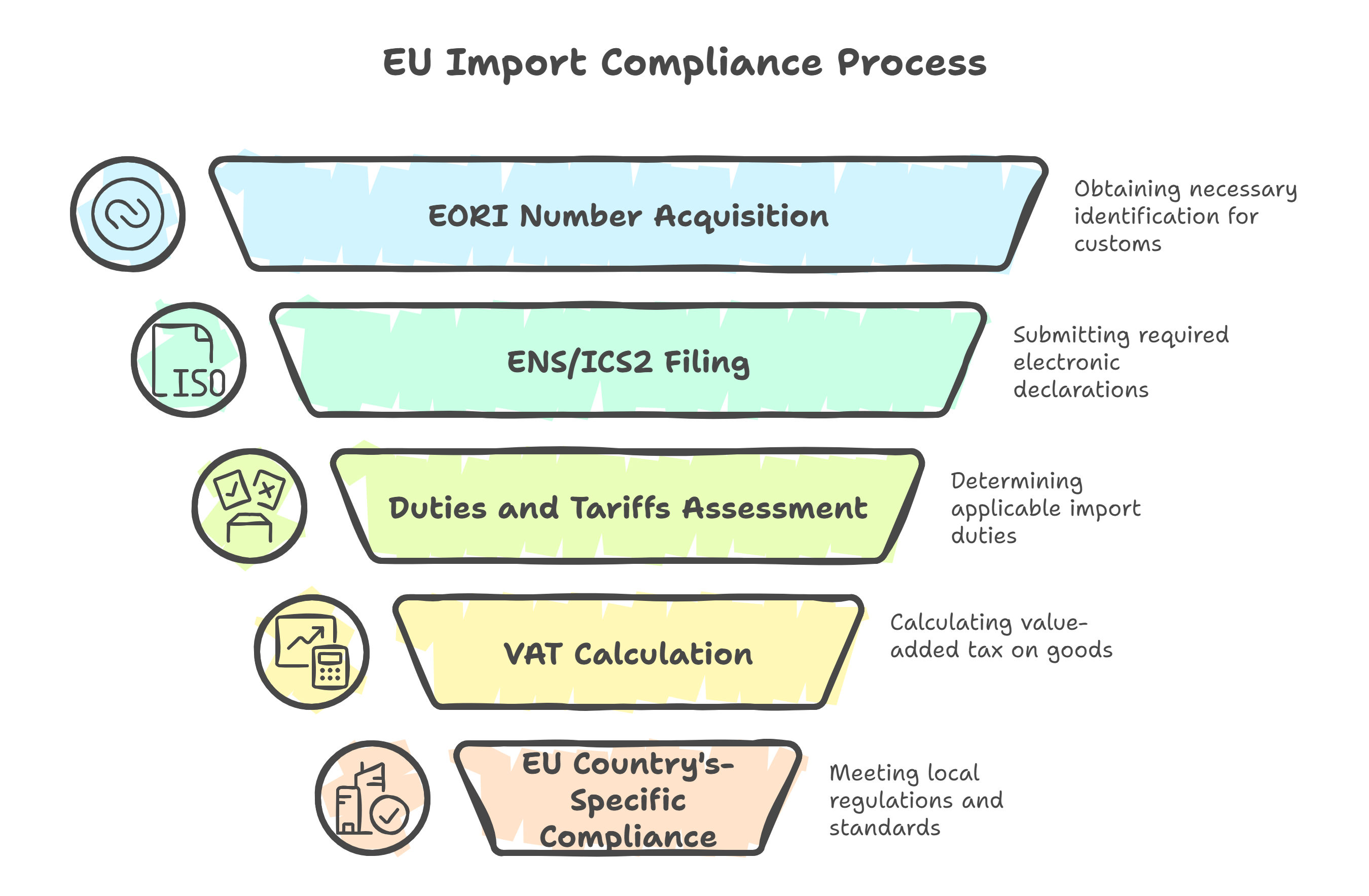

Step-by-Step: How to Import to Romania

1. EORI Registration (For Commercial Shipments)

Anyone importing goods for business purposes into the EU must register for an EORI (Economic Operators Registration and Identification) number.

- Used for customs processing across all EU countries

- Easily obtainable through the Romanian customs authority

- Not required for personal-use shipments

2. Required Documents

To clear customs in Romania, the following documents are typically needed:

- Bill of Lading (BOL) or Air Waybill

- Commercial invoice with HS codes and detailed product info

- Packing list

- Single Administrative Document (SAD)

- Certificate of Origin (for trade agreement benefits, if applicable)

- Import licenses or permits (if goods are restricted)

For personal shipments:

- Valid passport

- Proof of residency in Romania (visa or work contract)

- Inventory list of items

- Declaration of non-commercial use

All documentation must be consistent and accurate. Mismatches may result in customs holds or penalties.

3. Taxes and Exemptions

When shipping from the USA, these import taxes generally apply:

- Customs duties: Typically between 0%–12%, depending on the item

- Value-Added Tax (VAT): Standard Romanian rate is 19%

- Excise duties: May apply to alcohol, tobacco, and fuel products

Tax-Free Import for Personal Effects

Duty-free and VAT-free entry is possible if:

- The goods are used for personal, non-commercial use

- You’re moving to Romania and establishing permanent residence

- Items arrive within 6–12 months of your relocation

A knowledgeable international shipping company will help assess whether your shipment qualifies for exemptions and calculate your total international shipping cost.

Restricted and Prohibited Goods

Romania enforces EU-wide restrictions and local rules. Examples include:

Restricted Goods:

- Food, cosmetics, and medicine – Must comply with EU safety and labeling rules

- Electronic items and telecom equipment – CE certification required

- Plants and animal products – Require phytosanitary or veterinary certificates

- Firearms, drones, and defense items – Need government clearance

Prohibited Goods:

- Narcotics

- Counterfeit goods

- Offensive or obscene materials

- Dangerous chemicals

Shipping Personal Effects to Romania

If you're moving to Romania, you can bring your used household goods and personal belongings without duties or taxes if:

- You’ve lived outside the EU for at least 12 months

- You’re establishing legal residence in Romania

- Goods arrive within 12 months of relocation

- The items are not for resale

Required Documents:

- Passport

- Romanian visa, work contract, or residence permit

- Inventory list with value estimates

- Proof of relocation

- Customs declaration for exemption

New items or excess quantities may still be subject to VAT or duties.

Packaging & Labeling Requirements

Goods imported into Romania must follow EU labeling standards, including:

- Product information in Romanian for consumer goods

- Metric measurements

- Manufacturer/importer details

- CE marking (for applicable products like electronics and toys)

- Expiry or production dates for food, medicine, and cosmetics

All wooden crates and pallets must comply with ISPM 15, which requires them to be heat-treated and properly marked to prevent pest risks.

Who Can Help?

Use a Licensed Broker or an International Shipping Company

A reliable international shipping company or Romanian customs broker can:

- Handle EORI registration and customs declarations

- Classify products under the correct HS codes

- Calculate total import charges

- Help claim relocation-based tax exemptions

- Offer delivery from the port to the final destination in Romania

This professional support makes affordable shipping to Romania not only possible, but predictable and hassle-free.

Final Import Checklist for Romania

| ✅ Requirement | Applies to | Action |

|---|---|---|

| EORI number | Business imports | Required for customs declaration |

| SAD form | All shipments | Used for EU customs processing |

| VAT (19%) | Most imports | Applied to value + duty |

| Customs duties (0–12%) | Commercial and personal goods | Based on HS classification |

| ISPM 15 wood packaging | Crates and pallets | Mandatory for entry |

| Romanian labeling | Consumer products | Must comply with EU and national rules |

| Declaration of non-commercial use | Household goods | Needed for tax exemption |

Conclusion: Shipping to Romania from the USA

Romania’s position within the EU ensures consistent customs procedures; however, it’s still essential to prepare documentation carefully and plan ahead. Whether you’re moving to Romania or sending goods for business, choosing the right partner can make the process smooth and cost-effective.

An experienced international shipping company can guide you through every step, helping you reduce your international shipping costs and enjoy affordable shipping from the U.S. to Romania.

.png)