|

|

Less-than-Container-Load | Affordable International Shipping | 7-Step Guide

Shipping to Lithuania from the USA

Lithuania Import Regulations: A Complete Guide for U.S. Shippers

Lithuania, a member of the European Union and the Schengen Zone, is a growing logistics hub in Northern Europe. Whether you’re shipping from the USA for business or personal reasons, understanding Lithuania’s customs process ensures timely delivery and avoids unexpected costs.

This guide explains customs procedures, documentation, taxes, and how a trusted international shipping company can streamline the process and reduce your international shipping costs.

Key Facts About Importing to Lithuania

Lithuania adheres to EU customs rules, which the State Tax Inspectorate and the Lithuanian Customs Department administer.

- Imports from non-EU countries, including the U.S., are subject to customs duties, VAT, and occasionally excise taxes.

- Businesses must register for an Economic Operator Registration and Identification (EORI) number.

- Used personal goods may qualify for duty-free entry under EU relocation provisions.

Partnering with an experienced international shipping company ensures correct filings and smooth delivery, resulting in affordable shipping from the U.S.

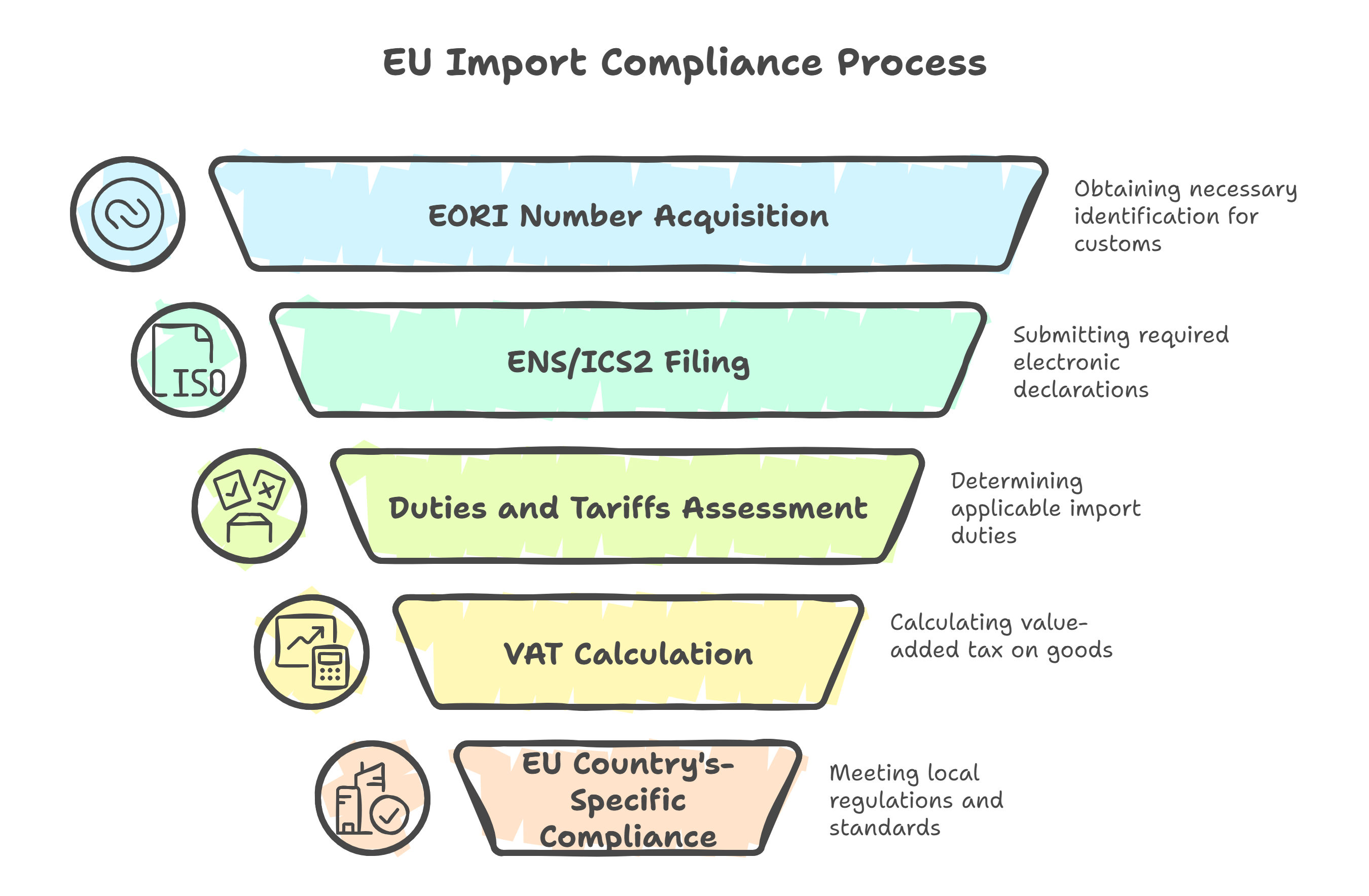

Step-by-Step: How to Import to Lithuania

1. Obtain an EORI Number (for Businesses)

- All EU commercial imports require an EORI (Economic Operators Registration and Identification) number.

- Individuals shipping personal effects do not need one.

2. Required Documents

To clear customs in Lithuania, you'll typically need:

- Bill of Lading (BOL) or Air Waybill

- Commercial invoice (listing product details, HS codes, values)

- Packing list

- Certificate of Origin (if needed for preferential tariffs)

- Import declaration (SAD – Single Administrative Document)

- Import licenses (for restricted goods)

For personal shipments:

- Passport

- Visa or residence permit

- Inventory list

- Declaration of non-commercial use

- Proof of relocation (rental contract, job offer)

All documents must be accurate and submitted on time to avoid clearance delays.

3. Duties, VAT, and Tax Exemptions

If you're shipping from the USA to Lithuania, you may encounter:

- Customs duties: Typically 0–12% based on product classification

- VAT: Standard rate is 21%, applied on CIF value + duty

- Excise tax: Applies to alcohol, tobacco, fuel, and luxury items

Tax-Free Import of Personal Goods

You may be eligible for duty- and VAT-free import of household goods if:

- You are moving to Lithuania as your primary residence

- Items are used and owned for 6+ months

- Goods are not intended for resale

- Shipment arrives within 12 months of relocation

A seasoned international shipping company can help secure this exemption and reduce your international shipping costs.

Restricted and Prohibited Items

Restricted Items (require special permits):

- Medications – Must be declared and limited to personal use

- Alcohol and tobacco – Subject to limits and excise tax

- Firearms – Require authorization from the Lithuanian police

- Food, plants, and cosmetics – Must comply with EU health regulations

- Electronics – Require CE marking

Prohibited Items:

- Narcotics and controlled substances

- Counterfeit goods

- Endangered species or products violating CITES

- Pornographic material

Shipping Personal Effects to Lithuania

If you’re relocating to Lithuania, you can import used personal goods tax-free by meeting certain conditions:

- You must have lived outside the EU for 12+ months

- You are moving to Lithuania permanently

- Goods must be used and listed in an inventory

- You must commit to not selling the items for 12 months after import

Required Documents:

- Passport and visa/residence permit

- Inventory list

- Proof of prior residence abroad

- Customs declaration for personal goods

New items may be subject to tax, even in personal shipments.

Packaging and Labeling Requirements

- Products must comply with EU labeling laws

- CE marking is required for electronics, toys, and appliances

- Labels for food, cosmetics, and supplements must be in Lithuanian

- Wood packaging materials (crates, pallets) must meet ISPM 15 standards (heat-treated and marked)

Who Can Help?

Work With a Professional International Shipping Company

Whether you're a business or individual, working with a reliable international shipping company is the best way to:

- Accurately file customs paperwork

- Register or advise on EORI numbers

- Navigate EU tax and labeling rules

- Coordinate final delivery in Lithuania

- Secure affordable shipping and avoid delays

Final Import Checklist for Lithuania

| ✅ Requirement | Applies to | Action |

|---|---|---|

| EORI number | Business shipments | Required for EU customs clearance |

| SAD declaration | All imports | Must be filed with Lithuanian Customs |

| VAT (21%) | Most imported goods | Applied to total value + shipping + duties |

| ISPM 15 compliance | Wood packaging | Required for non-EU wooden crates or pallets |

| CE marking | Electronics and toys | Mandatory for EU market products |

| Proof of relocation | Personal shipments | Needed to qualify for a duty-free exemption |

Conclusion: Shipping to Lithuania from the USA

Lithuania's location and modern customs framework make it a practical destination for both U.S. exporters and individuals relocating to the EU. With the proper paperwork and local guidance, your shipment can move efficiently and economically.

By working with an experienced international shipping company, you can simplify customs clearance, minimize costs, and benefit from safe, affordable shipping from the USA to Lithuania.

.png)