|

|

Less-than-Container-Load | Affordable International Shipping | 7-Step Guide

Shipping Goods to Greece from the USA

Greece Import Regulations: A Complete Guide for U.S. Shippers

Whether you’re relocating, sending commercial goods, or supporting international trade, shipping from the USA to Greece requires a proper understanding of EU and national regulations. Greece, as a member of the European Union, adheres to EU-wide customs and VAT procedures, while also maintaining local protocols for clearance and inspection.

This guide explains what U.S. exporters and individuals need to know about international shipping to Greece, including required documentation, duties, and taxes. It also shows how a trusted international shipping company can help reduce delays and keep your international shipping costs manageable.

Key Facts About Importing to Greece

Greece enforces EU customs law, with oversight by the Independent Authority for Public Revenue (AADE).

- All imports from non-EU countries (like the U.S.) are subject to customs duties, VAT, and sometimes excise taxes.

- Businesses must obtain an EORI number.

- Personal shipments may qualify for duty- and tax-free entry under EU relocation exemptions.

A knowledgeable international shipping company will ensure your documentation is accurate, helping you achieve smooth and affordable shipping from the U.S.

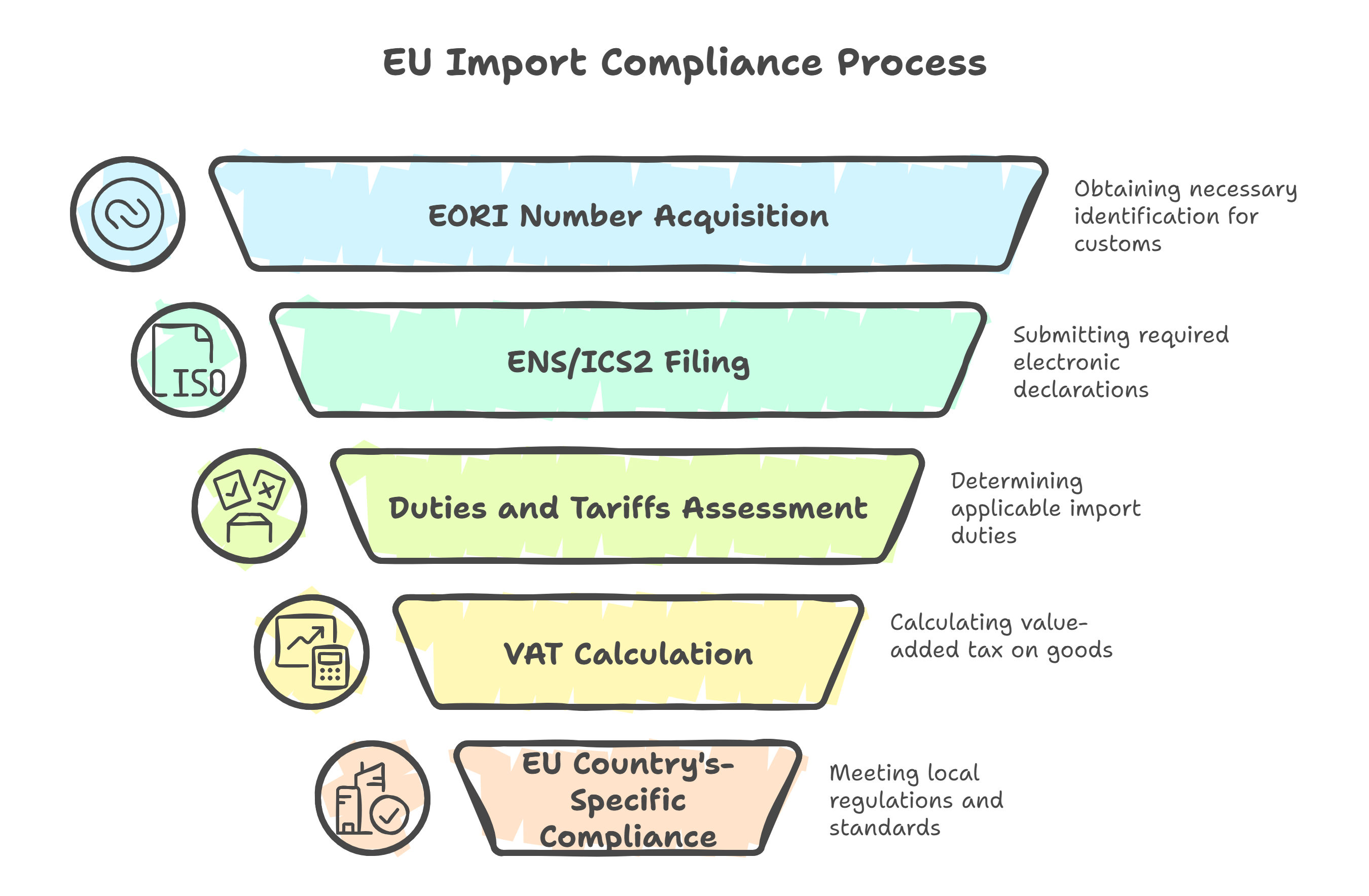

Step-by-Step: How to Import to Greece

1. Obtain an EORI Number (Business Shipments)

- All commercial imports into the EU require an EORI (Economic Operators Registration and Identification) number.

- Individuals shipping personal belongings do not need one.

2. Required Documents

To clear customs in Greece, the following are typically required:

- Bill of Lading (BOL) or Air Waybill

- Commercial invoice (with values, HS codes, and origin)

- Packing list

- Certificate of Origin (where applicable)

- Import Declaration (SAD – Single Administrative Document)

- Import licenses or health certificates (if needed)

For personal effects:

- Passport

- Greek visa or residence permit

- Inventory list

- Proof of address in Greece

- Signed declaration of personal use

Any inconsistencies in documents can cause delays or penalties.

3. Duties, VAT, and Exemptions

If you're shipping from the USA to Greece, you may encounter:

- Customs duties: Usually 0–12%, depending on the product

- VAT: Standard rate is 24%, calculated on CIF (cost + insurance + freight) + duty

- Excise taxes: May apply to alcohol, tobacco, luxury items

Duty-Free Import of Personal Effects

You may qualify for duty- and VAT-free import if:

- You’re relocating your primary residence to Greece

- Goods are used and owned for at least 6 months

- You commit to not reselling them for 12 months after import

- You import them within 12 months of your relocation

A trusted international shipping company can guide you through claiming these exemptions and reducing your international shipping costs.

Restricted and Prohibited Items

Restricted Goods:

- Alcohol and tobacco – Subject to excise and VAT

- Firearms – Require police permits

- Electronics – Must have CE marking

- Food and supplements – Subject to Greek Food Authority review

- Medications – Require prescription or import approval

Prohibited Goods:

- Narcotics and psychotropic substances

- Counterfeit products

- Culturally protected artifacts

- Hazardous chemicals (without permits)

Shipping Personal Effects to Greece

When moving to Greece, you can ship used personal goods and household items duty-free, provided:

- You’ve lived outside the EU for at least 12 months

- Your move to Greece is permanent

- Goods are for personal use only

- You have lived abroad for a minimum of 12 continuous months

Required Documents:

- Valid passport

- Proof of residence abroad and in Greece

- Inventory list (in Greek or English)

- Customs exemption declaration

New or commercial-looking goods may not qualify for exemption.

Packaging and Labeling Requirements

Retail goods shipped to Greece must comply with EU labeling rules:

- CE marking is required for electronics, toys, and machinery

- Labels must be in Greek, especially for food, cosmetics, and household items

- Food items must list ingredients, allergens, and expiration dates

- Wooden packaging (pallets, crates) must comply with ISPM 15 (heat-treated and stamped)

Who Can Help?

Partner With an International Shipping Company

To avoid delays, fines, or rejected shipments, it's best to work with a professional international shipping company. They can:

- Handle EU customs clearance and document filing

- Provide guidance on VAT and exemption eligibility

- Coordinate with Greek customs brokers and inspectors

- Offer door-to-door or port-to-door affordable shipping options

Their expertise ensures safe and cost-efficient international shipping to Greece.

Final Import Checklist for Greece

| ✅ Requirement | Applies to | Action |

|---|---|---|

| EORI number | Business shipments | Required for customs processing |

| VAT (24%) | Most goods | Charged on the import value plus duty |

| CE marking | Electronics, toys | Mandatory for EU sales |

| Greek-language labeling | Food and retail items | Required for consumer goods |

| ISPM 15 compliance | Wood packaging | Required for sea freight pallets/crates |

| Proof of relocation | Personal shipments | Needed for duty-free eligibility |

Conclusion: Shipping to Greece from the USA

Greece’s position within the EU makes it a highly regulated but transparent destination for imports. Whether you're relocating or exporting, following the proper customs procedures is crucial.

A reliable international shipping company can help you manage all requirements, minimize delays, and reduce your international shipping costs. With professional support, affordable shipping from the U.S. to Greece becomes a smooth, stress-free process.

.png)