|

|

Less-than-Container-Load | Affordable International Shipping | 7-Step Guide

Shipping Goods to Estonia from the USA

Estonia Import Regulations: A Complete Guide for U.S. Shippers

Estonia is a digital-first economy and a member of the European Union, making it an attractive destination for trade, relocation, and e-commerce. If you’re shipping from the USA to Estonia, it’s essential to follow EU customs protocols, understand the tax implications, and accurately declare all cargo.

This guide outlines the regulations for importing to Estonia. It explains how a reliable international shipping company can simplify customs clearance and reduce your international shipping costs through well-managed logistics and documentation.

Key Facts About Importing to Estonia

Estonia adheres to EU customs and VAT regulations, which are administered by the Estonian Tax and Customs Board (MTA).

- Shipments from outside the EU, including the U.S., are subject to customs duties, VAT, and occasionally excise taxes.

- Businesses must obtain an EORI number.

- Individuals relocating to Estonia can qualify for duty-free import of household goods.

With a knowledgeable international shipping company, your goods can clear customs faster and reach Estonia through affordable shipping channels.

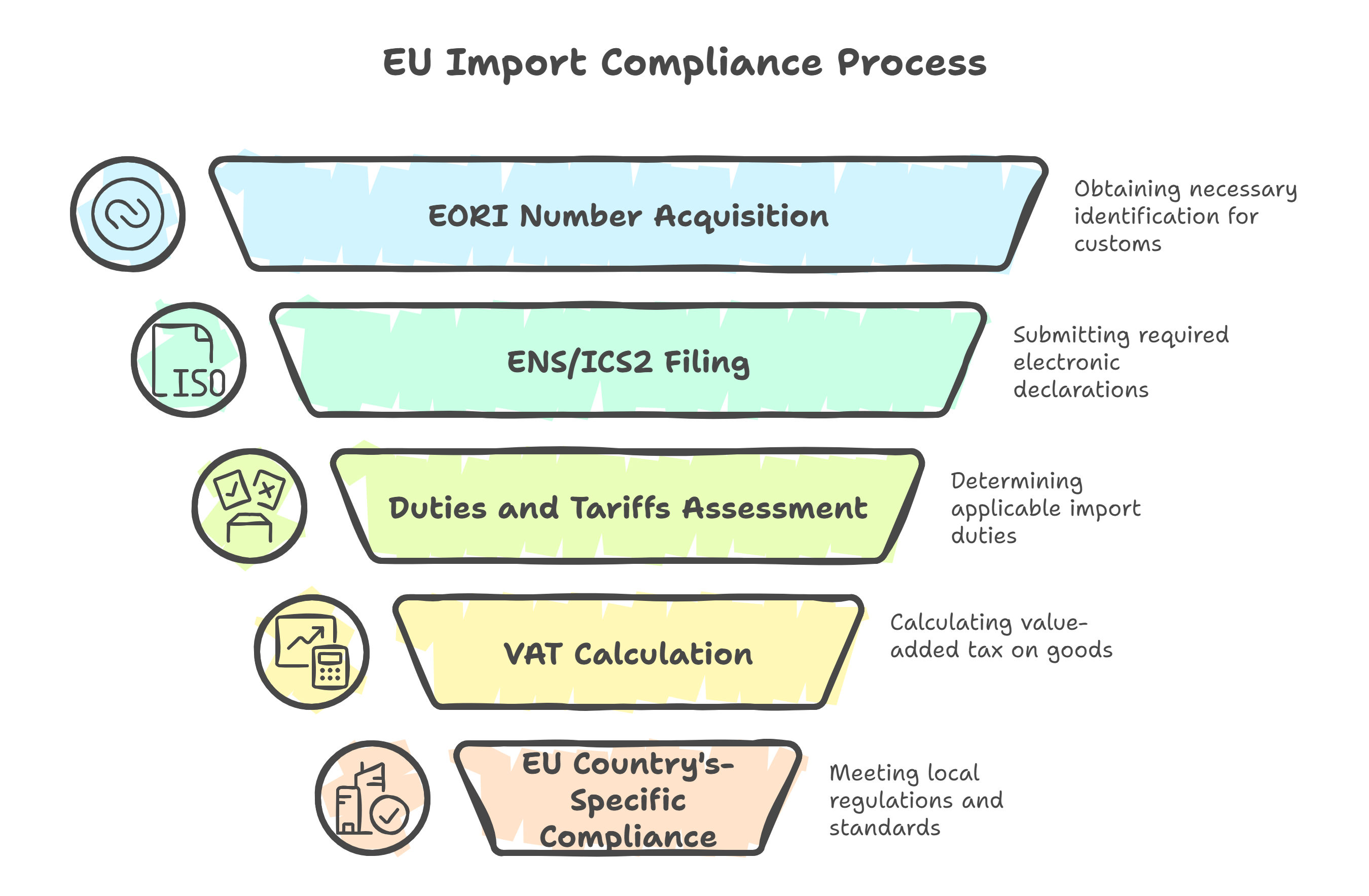

Step-by-Step: How to Import to Estonia

1. Register for an EORI Number (for Business Importers)

- Commercial shipments to Estonia require an EORI (Economic Operators Registration and Identification) number for customs declarations.

- Private individuals do not need an EORI number when shipping personal goods.

2. Required Documentation

To successfully clear Estonian customs, provide the following:

- Bill of Lading (BOL) or Air Waybill

- Commercial invoice (listing values, HS codes, and origin)

- Packing list

- Certificate of Origin (for tariff relief under trade agreements)

- Import declaration (SAD – Single Administrative Document)

- Import licenses (if needed for specific goods)

For personal effects:

- Passport

- Visa or Estonian residence permit

- Inventory list

- Declaration of personal use

- Proof of relocation (employment contract, lease, etc.)

Ensure that all documents are consistent and filed electronically through the EU Customs portal.

3. Duties, VAT, and Tax Exemptions

For shipments from the USA to Estonia, you’ll need to consider:

- Customs duties: Typically 0–12%, depending on the product classification

- VAT (Value Added Tax): Standard rate is 20%, calculated on the CIF value (Cost + Insurance + Freight) + duties

- Excise duties: Apply to alcohol, tobacco, fuel, and vehicles

Exemptions for Personal Relocation

You may be eligible for duty- and VAT-free import of personal belongings if:

- You’ve lived outside the EU for 12+ months

- You’re establishing permanent residence in Estonia

- Goods are used and owned for at least 6 months

- You declare them for personal use only and not for resale

An experienced international shipping company can help you prepare and file these exemptions properly to reduce your international shipping costs.

Restricted and Prohibited Items

Restricted Items:

- Alcohol and tobacco – Limited quantities, subject to excise

- Firearms and ammunition – Require police clearance and registration

- Medications – Must be for personal use with a prescription

- Food and plant products – Require health certification

- Electronics and machinery – Must carry CE marking

Prohibited Items:

- Narcotics and controlled substances

- Counterfeit goods

- Endangered species (under CITES)

- Explosives and hazardous chemicals (without authorization)

Shipping Personal Effects to Estonia

Estonia allows duty-free import of personal belongings for qualifying individuals relocating from outside the EU. These goods must:

- Be used and clearly for personal use

- Be owned for 6+ months before import

- Be imported within 12 months of moving to Estonia

- Not be sold or transferred for at least 12 months after arrival

Required Documents:

- Passport and residence permit

- Proof of previous non-EU residence

- Proof of Estonian address or employment

- Inventory list

- Customs declaration for exemption

New items or those not clearly for personal use may still incur VAT and duty.

Packaging and Labeling Requirements

Imported goods to Estonia must comply with EU labeling and packaging standards:

CE marking is required for electronics, toys, and machinery. Consumer product labels must include:

Contents

Usage instructions

Safety warnings (if applicable)

Information in Estonian or English

Wood packaging materials must comply with ISPM 15 (heat-treated and stamped)

Who Can Help?

Work With an International Shipping Company

To ensure a successful shipment, work with a licensed and experienced international shipping company. They can:

- Prepare your customs documentation

- Coordinate EORI registration (for businesses)

- Advise on VAT, CE requirements, and exemptions

- Offer affordable shipping options, including LCL (Less than Container Load) and full container service

- Manage local delivery or customs brokerage in Estonia

Final Import Checklist for Estonia

| ✅ Requirement | Applies to | Action |

|---|---|---|

| EORI number | Business shipments | Required for all EU import declarations |

| SAD customs declaration | All shipments | Filed electronically via the EU system |

| VAT (20%) | Most goods | Charged on CIF value + duty |

| ISPM 15 compliance | Wood packaging | Required for crates and pallets |

| CE marking | Electronics, toys, machinery | Mandatory for EU import and sale |

| Proof of relocation | Personal shipments | Required for VAT and duty exemption |

Conclusion: Shipping to Estonia from the USA

Estonia’s digital infrastructure and alignment with the EU make it an efficient destination for U.S. shippers. However, proper customs handling and documentation are critical to avoid unexpected fees and delays.

A trusted international shipping company can help you manage EORI registration, tax exemptions, CE compliance, and document preparation, ensuring fast and affordable shipping from the USA to Estonia.

.png)