|

|

Less-than-Container-Load | Affordable International Shipping | 7-Step Guide

Shipping Goods to Denmark from the USA

Denmark Import Regulations: A Complete Guide for U.S. Shippers

Denmark is a highly developed, trade-friendly member of the European Union and a top destination for both commercial and personal shipments from the United States. Whether you're shipping from the USA for business, relocation, or e-commerce, you’ll need to follow EU and Danish import rules to avoid delays and penalties.

This guide explains how to prepare for international shipping to Denmark, covering required documents, taxes, prohibited items, and how an experienced international shipping company can help reduce your international shipping costs and ensure affordable shipping.

Key Facts About Importing to Denmark

Denmark adheres to European Union customs laws, which are regulated by the Danish Customs and Tax Administration (SKAT).

- All non-EU shipments are subject to customs clearance, duties, and Value-Added Tax (VAT).

- Commercial importers are required to have an EORI number.

- Individuals relocating to Denmark may be eligible for tax-free import of used household goods.

A qualified international shipping company can handle documentation, provide compliance guidance, and help you manage international shipping costs efficiently.

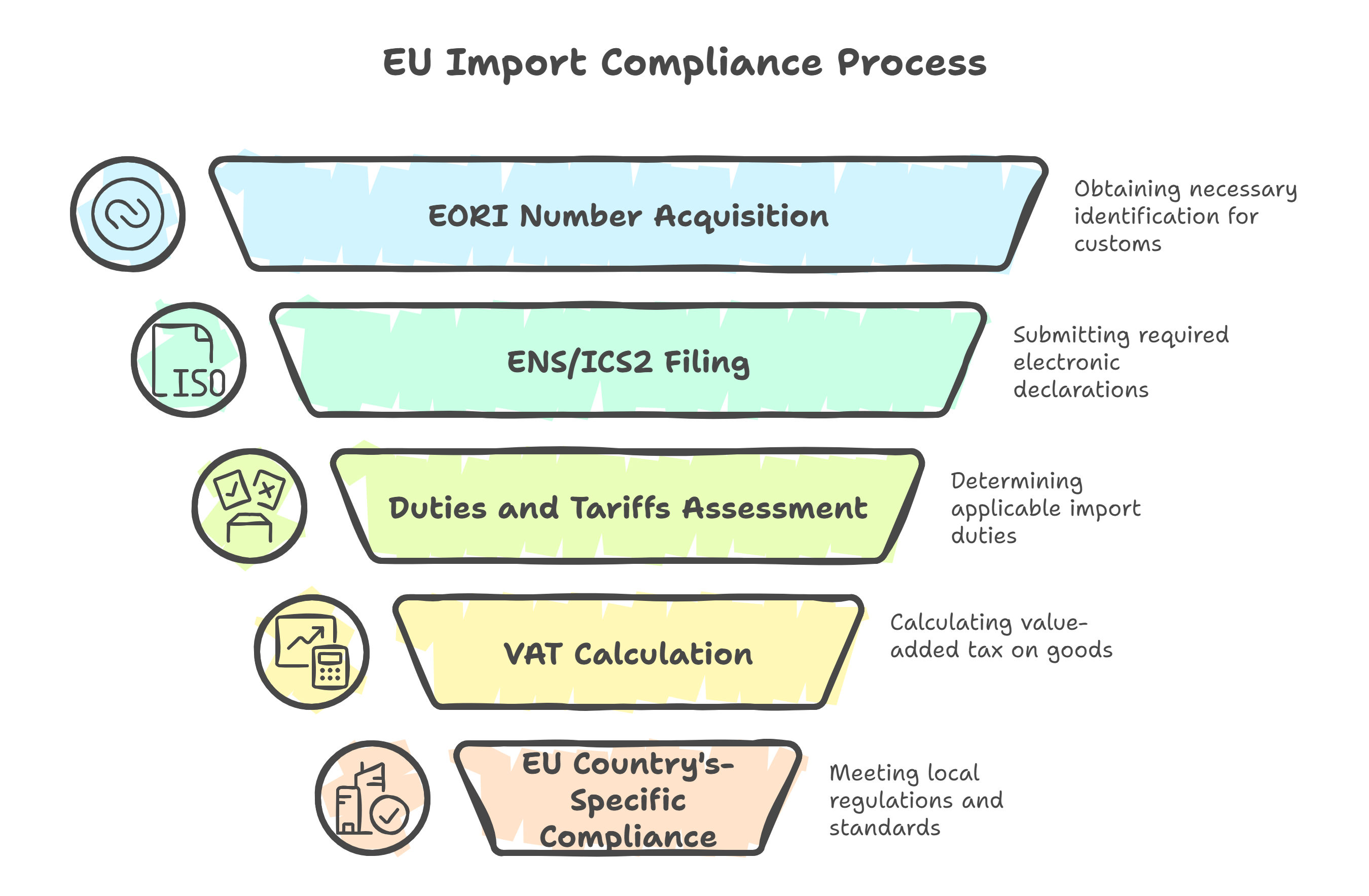

Step-by-Step: How to Import to Denmark

1. EORI Registration (For Commercial Imports)

Commercial shippers must register for an EORI (Economic Operators Registration and Identification) number within the EU.

- Used for customs declarations across EU member states

- Not required for private individuals importing personal goods

2. Prepare Required Documents

To clear customs, you’ll need the following:

- Bill of Lading (BOL) or Air Waybill

- Commercial invoice with HS codes and product value

- Packing list

- Customs declaration (SAD form)

- Certificate of Origin (when applying for preferential tariffs)

- Import licenses for restricted goods

For personal shipments:

- Passport

- Inventory list

- Proof of moving to Denmark (residency permit, visa, work contract)

- Declaration of non-commercial use

Consistency across documents is crucial in preventing customs issues and unnecessary delays.

3. Duties, VAT, and Personal Exemptions

Denmark, like all EU countries, applies:

Customs duties: Typically 0–12%, based on product classification

VAT: Charged at 25%, one of the highest in Europe

Excise taxes: May apply to alcohol, tobacco, and energy products

Tax-Free Imports for Personal Effects:

You may qualify for duty-free and VAT-free entry of personal belongings if:

- You are moving your permanent residence to Denmark

- Goods are used, personally owned, and not intended for resale

- Items arrive within 12 months of establishing residence

> An experienced international shipping company can help you estimate total international shipping costs and determine tax exemption eligibility.

Restricted and Prohibited Goods

Denmark adheres to EU-wide restrictions and local safety laws. Items that require permits include:

Restricted Goods:

- Pharmaceuticals and supplements – Danish Medicines Agency

- Alcohol and tobacco – Subject to excise regulations

- Firearms and ammunition – Strictly controlled

- Food, plants, and animal products – Require veterinary/phytosanitary certificates

Prohibited Goods:

- Counterfeit items

- Illegal drugs

- Obscene or offensive media

- Dangerous chemicals

Shipping Personal Effects to Denmark

If you’re relocating, you may ship used household goods and personal effects without paying duties or VAT, provided you meet these conditions:

Requirements:

- The items are used, personally owned, and not for resale

- You’re establishing legal residence in Denmark

- Shipment arrives within 6 months before or 12 months after your move

Required Documents:

- Valid passport

- Proof of residence or Danish CPR registration

- Detailed inventory list

- Declaration confirming non-commercial use

New items or large quantities of similar goods may be flagged and taxed.

Packaging & Labeling Requirements

Retail goods imported into Denmark must meet EU labeling standards:

- Labels must be in Danish or include a translation

- Must include product name, manufacturer/importer, origin, and usage instructions

- Food, medicine, and cosmetics must show expiration/manufacture dates and ingredients

- Metric units are required

Wood packaging (crates, pallets) must comply with ISPM 15, which requires heat treatment and stamping. Non-compliant materials may be refused or subject to fumigation at the customer's expense.

Who Can Help?

Work With a Licensed Customs Broker or International Shipping Company

A Danish customs broker or a trusted international shipping company can:

- Register and submit EORI documents

- File customs declarations and HS code classifications

- Calculate duties, VAT, and applicable exemptions

- Offer port handling and final delivery within Denmark

Choosing professionals ensures smooth entry and affordable shipping from the U.S. to Denmark.

Final Import Checklist for Denmark

| ✅ Requirement | Applies to | Action |

|---|---|---|

| EORI number | Commercial shipments | Must register before clearance |

| SAD customs declaration | All goods | Required for EU import |

| Customs duty (0–12%) | Based on the product | Use the correct HS classification |

| VAT (25%) | All imports | Applies unless exempt |

| ISPM 15 wood packaging | Crates and pallets | Required for sea freight |

| Danish labeling | Retail products | Must comply with EU rules |

| Declaration of personal use | Household goods | Needed to claim tax exemption |

Conclusion: Shipping to Denmark from the USA

Denmark offers a streamlined, transparent import process, especially for those familiar with EU customs rules. Whether you're relocating or shipping goods commercially, documentation accuracy and regulatory compliance are critical.

Partnering with an experienced international shipping company ensures peace of mind, helps reduce your international shipping cost, and guarantees affordable shipping from the U.S. to Denmark.

.png)