|

|

Less-than-Container-Load | Affordable International Shipping | 7-Step Guide

Shipping Goods to Sweden from the USA

Sweden Import Regulations: A Complete Guide for U.S. Shippers

Sweden is a key import destination within the European Union (EU) and offers a transparent, tech-forward customs process. Whether you’re a business exporter or an individual shipping from the USA, understanding Swedish customs regulations is essential to avoid delays, manage taxes, and minimize your international shipping costs.

This article explains the import process to Sweden, including required documents, taxes, and EU compliance, as well as how an experienced international shipping company can help ensure smooth and affordable shipping to Stockholm, Gothenburg, Malmö, or any other part of the country.

Key Facts About Importing to Sweden

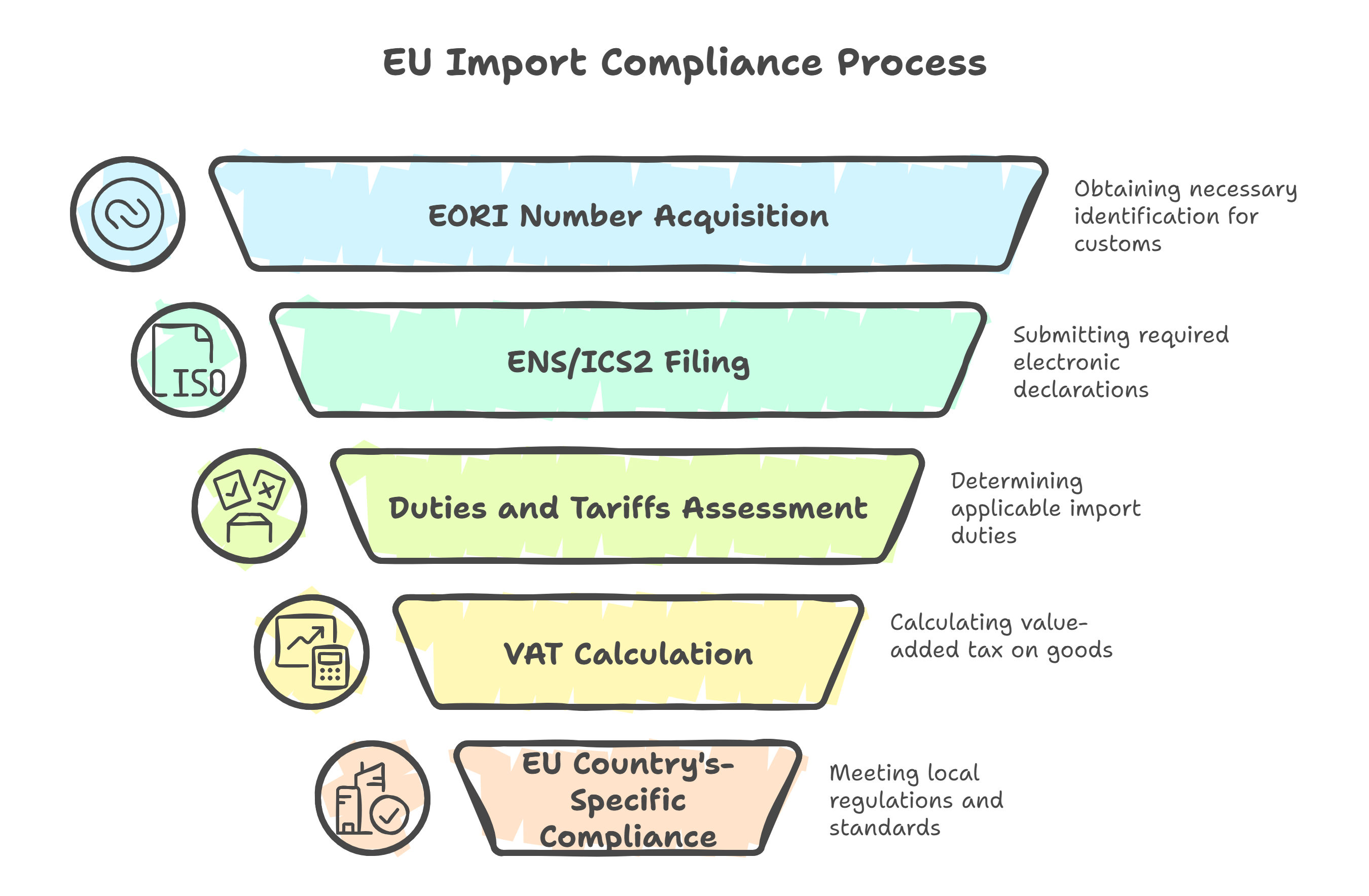

Sweden is an EU member; therefore, EU import and VAT regulations apply.

- An EORI number is required for all commercial shipments.

- Imports are subject to customs duties and 25% Swedish VAT.

- Most consumer goods must comply with CE marking and EU labeling standards.

- Personal effects may be imported duty-free under relocation rules.

Partnering with a trusted international shipping company simplifies compliance and lowers costs.

Step-by-Step: How to Import to Sweden

1. Obtain an EORI Number (for Businesses)

Commercial importers must have an EORI (Economic Operators Registration and Identification) number registered with Swedish Customs (Tullverket).

- EU-based businesses apply through Sweden’s customs portal.

- U.S. exporters typically coordinate with a broker or international shipping company to file on their behalf.

2. Prepare Required Import Documents

Ensure you or your broker has the following:

- Commercial invoice or pro forma invoice

- Packing list

- Bill of Lading or Air Waybill

- Certificate of Origin (if claiming preferential duty rates)

- Customs declaration (using Sweden’s TDS system)

- EORI number

Personal shipments require:

- Detailed inventory list

- Passport

- Proof of relocation (visa, job contract, or residency permit)

3. Calculate Duties and VAT

Like all EU countries, Sweden applies:

- Customs duties: Based on the item’s classification and country of origin (0–12%)

- VAT (25%): Applied on the CIF value + duty

Reduced VAT rates (6% or 12%) may apply to books, food, and medicines. If the Certificate of Origin qualifies under a trade agreement, it may result in reduced or waived duties.

4. Comply with EU Product Standards

Sweden enforces EU regulations for consumer protection, safety, and environmental standards. Items typically requiring compliance include:

- CE-marked products (toys, electronics, machinery, etc.)

- REACH compliance for chemicals

- Energy efficiency labeling for appliances

- RoHS compliance for electronics

Labels must be in Swedish or another accepted EU language, and include:

- Product name and description

- Manufacturer/importer contact info

- Instructions and warnings

- Country of origin

A professional international shipping company can confirm product compliance before shipment.

Shipping Personal Effects to Sweden

If you’re relocating, you can import used household goods tax and duty-free under the Transfer of Residence scheme.

To Qualify:

- You’ve lived outside the EU for at least 12 months

- Items were used for at least 6 months

- You are moving your permanent residence to Sweden

- The shipment arrives within 1 year of your arrival

Required Documents:

- Valid passport

- Swedish residence visa or permit

- Detailed inventory list

- Proof of address in Sweden (e.g., lease or employer letter)

Duty-free entry is limited to one shipment per household.

Labeling & Packaging Requirements

Sweden follows EU labeling laws for most goods. Requirements include:

- CE marking, where applicable

- Metric units (kg, cm, etc.)

- Swedish labeling for food, cosmetics, medicines, and consumer items

- Expiry dates and storage instructions for perishables

Failing to comply may result in delayed customs clearance or rejection.

A qualified international shipping company can assist with labeling review and pre-shipment compliance.

Who Can Help?

Use a Swedish Customs Broker or an International Shipping Partner

A Swedish customs agent or freight broker can:

- File your import declaration through the TDS portal

- Pay import taxes on your behalf

- Coordinate inspections and final delivery

Or let a full-service international shipping company handle both U.S. export and Swedish import formalities. This helps keep the process efficient and the international shipping cost manageable.

Final Import Checklist for Sweden

| ✅ Requirement | Applies to | Action |

|---|---|---|

| EORI number | Businesses | Register through Tullverket or the EU customs site |

| Customs declaration (TDS) | All shipments | Submit electronically or via a broker |

| Customs duties | Commercial goods | Based on HS code and origin |

| VAT (25%) | Most goods | Paid on CIF + duty |

| CE marking & EU compliance | Regulated products | Toys, electronics, machinery, etc. |

| Swedish labeling | Consumer goods | Required for food, cosmetics, and retail goods |

| Relocation allowance | Used household goods | Requires inventory, visa, and residency proof |

| Broker or shipping company | All imports | Strongly recommended for smooth entry |

Conclusion: Shipping to Sweden from the U.S.

Sweden offers a streamlined import process but requires full EU compliance. Whether you’re sending commercial goods or household items, accurate documentation and labeling are critical.

To save time and reduce your international shipping cost, rely on an experienced international shipping company to manage customs, duties, and delivery. With expert support, you can ensure safe, affordable shipping from the U.S. to Sweden—hassle-free.

.png)