|

|

Less-than-Container-Load | Affordable International Shipping | 7-Step Guide

Shipping Goods from the USA to Spain

Spain Import Regulations: A Complete Guide for U.S. Shippers

Spain is one of the largest import markets in the European Union and an important destination for U.S. exports. Whether you're a company exporting goods or an individual shipping from the United States, understanding Spain’s customs and VAT rules will help you avoid delays and reduce your international shipping costs.

This guide outlines Spain's import procedures, documentation requirements, tax structure, product compliance, and how a reliable international shipping company can simplify your logistics.

Key Facts About Importing to Spain

Spain is a member of the European Union, so EU customs rules apply.

- An EORI number is required for commercial imports.

- Imports are subject to customs duties and a 21% value-added tax (VAT).

- Regulated products must comply with EU labeling and CE marking rules.

- Personal items used may qualify for duty-free entry under the Transfer of Residence rules.

For the smoothest and most affordable shipping experience, consider partnering with a full-service international shipping company.

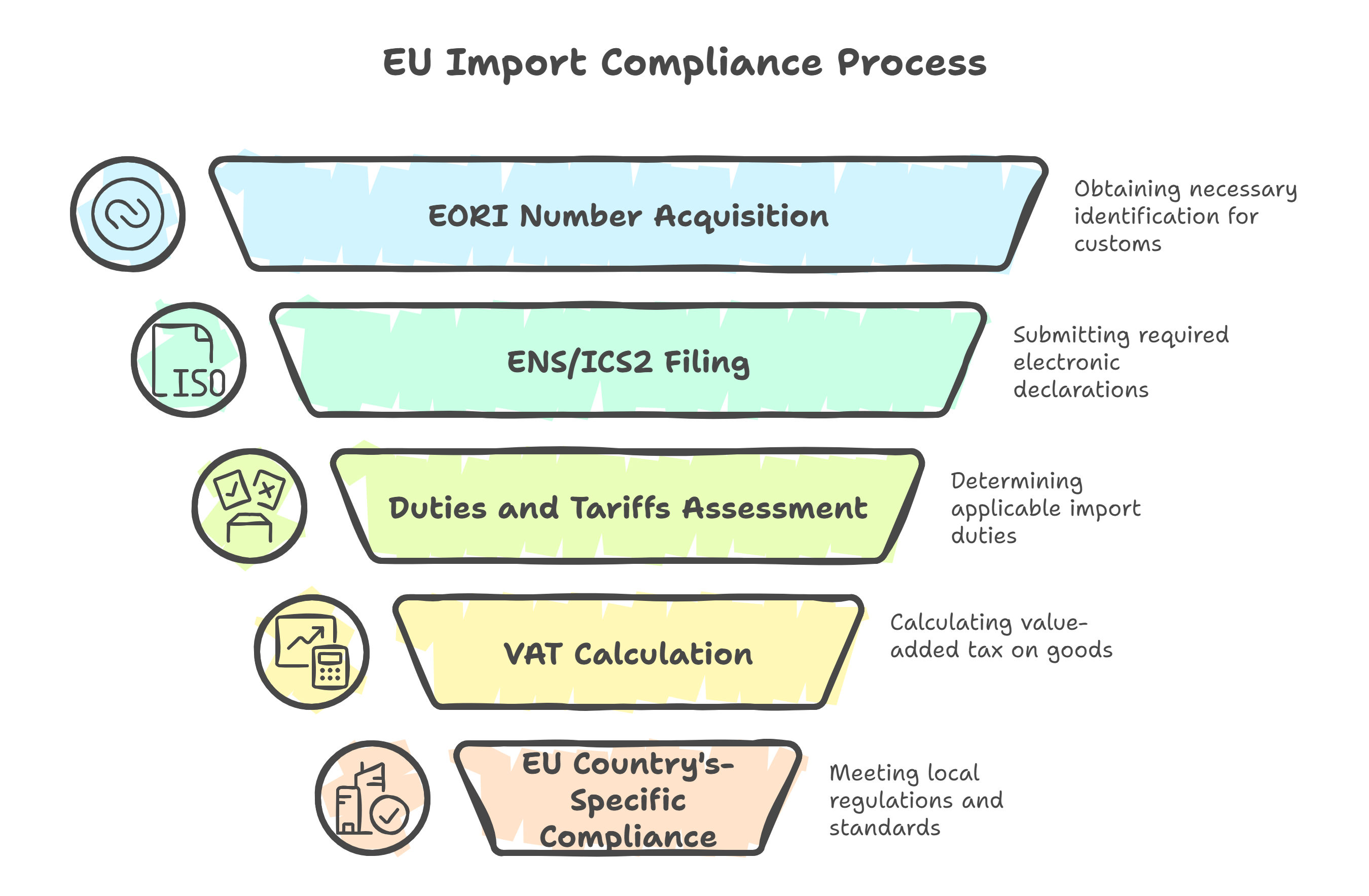

Step-by-Step: How to Import to Spain

1. Register for an EORI Number

All commercial importers must have an EORI (Economic Operators Registration and Identification) number. This number is used to declare goods to the Spanish Customs (Agencia Tributaria).

- Spain- or EU-based companies can apply directly online.

- U.S. exporters typically work with a local broker or international shipping company to file on their behalf.

2. Prepare Required Documentation

Ensure the following documents are ready before shipping:

- Commercial invoice or pro forma invoice

- Packing list

- Bill of Lading or Air Waybill

- Certificate of Origin (optional but may reduce duties)

- EORI number (for commercial shipments)

- Customs declaration through Spain’s Single Administrative Document (SAD)

If you’re shipping personal effects, include an inventory list in Spanish or English.

3. Calculate and Pay Duties and VAT

Spain uses the EU’s TARIC system to assess customs duties. Typically:

- Customs duty: 0% to 12% depending on the item

- VAT (IVA): 21% standard rate (charged on CIF + duty)

Some items may be subject to reduced VAT rates or exemptions. If your shipment qualifies under trade agreements (e.g., EU-U.S. agreements), the Certificate of Origin can reduce or eliminate customs duties.

4. Ensure EU Product Compliance

Spain enforces all EU product regulations. Depending on the goods, you may need:

- CE marking (required for electronics, toys, medical devices, etc.)

- Spanish labeling for food, textiles, cosmetics, and appliances

- REACH / RoHS compliance for chemicals and electronic goods

Labels must include:

- Product name and purpose

- Manufacturer/importer contact

- Country of origin

- Safety warnings or use instructions (in Spanish)

A qualified international shipping company can help ensure all labeling and documentation meet EU and Spanish standards before your goods leave the U.S.

Shipping Personal Effects to Spain

Spain allows duty- and VAT-free importation of used personal belongings if you’re relocating permanently.

To Qualify:

- You lived outside the EU for at least 12 months

- You’re moving your legal residence to Spain

- Goods have been owned and used for at least 6 months

- Items arrive within 1 year of your arrival

- Goods won’t be sold for at least 12 months

Documents Needed:

- Passport and Spanish residence permit or long-stay visa

- Proof of previous residence (e.g., lease, utility bill)

- Detailed inventory list in Spanish or English

- Declaration of Transfer of Residence

Do Not Pack:

- Alcohol or tobacco

- Firearms or restricted medical items

- Large amounts of new, unused items

Spain Labeling and Packaging Requirements

Consumer goods entering Spain must comply with EU packaging and labeling regulations. Most categories require:

- Labeling in Spanish

- CE marking (if regulated)

- Metric units (kg, cm)

- Product content, warnings, and storage instructions

For food, beverages, cosmetics, and household items, packaging must also include production and expiration dates, ingredients, and warnings about allergens.

Failure to comply may result in delayed customs clearance or penalties. A competent international shipping company can review packaging prior to shipping.

Who Can Help?

Use a Licensed Spanish Customs Agent or Freight Broker

They can:

- Submit your customs declaration

- Pay duties and VAT on your behalf

- Help with CE marking, labeling, and inspections

Alternatively, a full-service international shipping company can coordinate U.S. export and Spanish import logistics, ensuring affordable shipping with full compliance.

Final Import Checklist for Spain

| ✅ Requirement | Applies to | Action |

|---|---|---|

| Customs declaration | All shipments | Filed via the Tolletaten system |

| VAT (25%) | Most goods | Calculated on CIF + duty, paid before release |

| Customs duties | Varies by product | Higher for textiles and agricultural goods |

| CE marking / REACH compliance | Regulated products | Electronics, toys, machinery, etc. |

| Norwegian or English labeling | Consumer goods | Required for food, health, and electronics |

| Duty-free relocation | Personal household goods | Must prove relocation and use within 1 year |

| Certificate of Origin | Optional | It may help with duty calculation or exemptions |

| Broker or shipping company | All importers | Strongly recommended for U.S. exporters |

Conclusion: Efficient Shipping to Spain

Shipping to Spain from the U.S. is easy when you understand customs duties, VAT, and compliance requirements. Whether you’re relocating or engaging in international trade, proper documentation and EU conformity are crucial.

To minimize your international shipping cost and avoid delays, it’s best to partner with an experienced international shipping company. They’ll help you prepare your paperwork, ensure labeling compliance, and offer affordable shipping from the U.S. to Spain with full customs support.

.png)