|

|

Less-than-Container-Load | Affordable International Shipping | 7-Step Guide

Shipping Goods from the USA to the Netherlands

Netherlands Import Regulations: A Complete Guide for U.S. Shippers

The Netherlands is a key logistics gateway to Europe, boasting one of the most efficient customs systems in the European Union. Whether you're a business exporting goods or an individual shipping from the USA, understanding Dutch import rules is crucial for smooth customs clearance and minimizing your international shipping costs.

This article explains how to prepare your shipment, file customs declarations, and comply with EU regulations when shipping to the Netherlands. It’s especially useful for first-time exporters or people relocating to the country. A reliable international shipping company can ensure full compliance and provide affordable shipping options.

Key Facts About Importing to the Netherlands

The Netherlands is a member of the European Union (EU), which utilizes the EU Customs Code and TARIC for customs duties.

- EORI registration is mandatory for commercial imports.

- Imports are subject to a 21% VAT rate, plus customs duties, which vary depending on the product.

- CE marking and EU labeling laws apply to regulated products.

- Personal shipments may qualify for duty-free entry if you’re relocating.

With the Port of Rotterdam handling a significant portion of Europe’s container traffic, the Netherlands provides a fast and centralized entry point for U.S. shipments when handled by a skilled international shipping company.

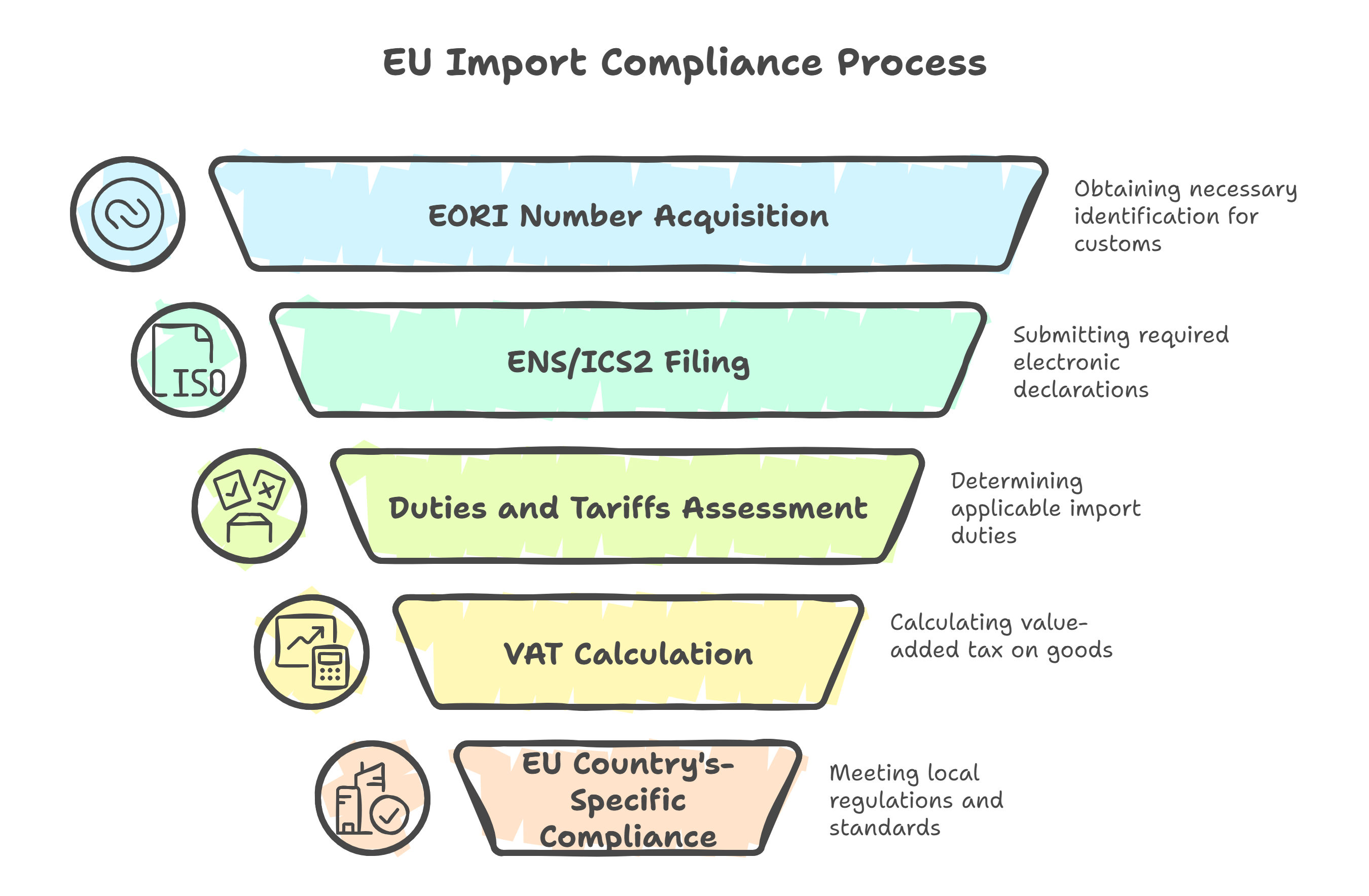

Step-by-Step: How to Import to the Netherlands

1. Register or Use an EORI Number

An EORI number (Economic Operators Registration and Identification) is required for all customs declarations within the EU.

- EU-based companies: Apply through the Dutch Customs Authority (Belastingdienst Douane).

- U.S. businesses: Must work with a customs broker or international shipping company that can file on their behalf.

2. Gather Required Documentation

For all imports into the Netherlands, prepare the following:

- Commercial invoice or itemized packing list

- Bill of Lading or Air Waybill

- Packing list

- EORI number (for business imports)

- Certificate of Origin (optional, helpful for trade agreement benefits)

- Declaration of value and use (especially for personal goods)

Your international shipping company can ensure all documents meet EU and Dutch customs standards.

3. Submit a Customs Declaration & Pay Duties and VAT

Customs duties are calculated according to EU rates using the TARIC system. Most goods entering the Netherlands are subject to:

- Customs duties: Vary by HS code (0–12% typical)

- VAT: Standard Dutch rate is 21%

VAT is applied to the CIF (Cost, Insurance, and Freight) value, plus any applicable duty. You can pay these charges electronically through your customs broker or have your international shipping company include them in your shipping quote.

4. Ensure Compliance with EU & Dutch Product Standards

The Netherlands enforces EU product regulations, including:

- CE marking for electronics, toys, medical devices, and machinery

- REACH and RoHS compliance for chemicals and electrical goods

- Dutch labeling laws for food, cosmetics, textiles, and more

Products must include labeling in Dutch or another EU language accepted in the Netherlands. Labels should state:

- Product name and type

- Country of origin

- Manufacturer/importer information

- Safety or usage warnings (if applicable)

Improper labeling may delay customs clearance or result in fines. Your international shipping company can review this before departure.

Shipping Personal Effects from the U.S. to the Netherlands

If you’re relocating to the Netherlands, you may import your used personal belongings duty-free under Transfer of Residence rules.

To Qualify:

- You lived outside the EU for at least 12 consecutive months

- You’re establishing residency in the Netherlands

- The goods were owned and used for at least 6 months

- You import the items within 12 months of your arrival

- You do not sell or transfer them within one year after import

Documents Needed:

- Dutch residence permit or long-stay visa

- Passport

- Inventory list in Dutch or English

- Proof of previous address (e.g., lease or utility bills)

- Declaration of Transfer of Residence (via Dutch Customs)

Avoid sending:

- Large quantities of new or unused goods

- Alcohol, tobacco, or prohibited items

- Items subject to CITES or strategic export controls

Labeling & Packaging Standards in the Netherlands

Products entering the Netherlands must comply with EU labeling and packaging rules. Key requirements include:

- Dutch or EU-approved language on consumer labels

- Metric units for weights and dimensions

- CE marking for relevant categories

- Expiration and manufacturing dates for food, drugs, and cosmetics

Non-compliant shipments may be delayed, rejected, or subject to fines. A qualified international shipping company can assist with pre-export label checks and ensure compliance with packaging standards.

Who Can Help?

- Use a Licensed Dutch Customs Broker or Freight Agent

They can:

- Submit your customs entry to Belastingdienst Douane

- Apply for any import permits or duty exemptions

- Communicate with the port and inspection authorities

- Pay taxes and arrange final delivery

Alternatively, choose a full-service international shipping company that handles customs clearance, port logistics, and inland transport across the Netherlands — all while keeping your international shipping costs under control.

Final Import Checklist for the Netherlands

| ✅ Requirement | Applies to | Action |

|---|---|---|

| EORI number | Commercial imports | Must be provided or filed by a broker/shipping company |

| Customs declaration | All shipments | File through the Dutch or EU system |

| Customs duties | Most commercial goods | Varies by HS code, check via TARIC |

| VAT (21%) | All imports | Applied to CIF value + duty |

| CE marking / compliance | Regulated products | Required for toys, electronics, medical, and more |

| Labeling in Dutch or the EU language | Consumer products | Food, cosmetics, electronics, textiles, etc. |

| Transfer of Residence allowance | Used personal effects | Exemption available for qualifying shipments |

| Certificate of Origin | U.S.-origin goods | Optional, may support duty exemption |

Conclusion: Shipping to the Netherlands Made Easy

The Netherlands offers one of Europe’s fastest and most efficient customs systems—but it still requires attention to detail. Whether you're shipping personal belongings or commercial goods, preparing proper documentation and complying with EU rules can save you time and money.

To reduce your international shipping costs and avoid clearance delays, work with a reliable international shipping company that is familiar with both U.S. export and Dutch import requirements. From documentation and labeling to final delivery, the right partner ensures affordable shipping with peace of mind.

.png)