|

|

Less-than-Container-Load | Affordable International Shipping | 7-Step Guide

Shipping Goods from the USA to Italy

Italy Import Regulations: A Complete Guide for U.S. Shippers

Italy is a member of the European Union and adheres to EU-wide customs regulations. However, it also enforces local Italian regulations that affect clearance, taxation, and inspections. If you’re shipping from the United States to Italy, this guide will help you understand the import procedures for both personal and commercial goods.

Whether you’re relocating, exporting, or handling e-commerce, understanding Italy’s requirements can help you minimize delays and manage your international shipping costs effectively. This article is tailored for individuals and businesses working with a trusted international shipping company. Key Facts About Importing to Italy

Italy adheres to EU customs and VAT regulations, utilizing the TARIC system for duty classification.

EORI registration is mandatory for importers in the EU customs territory.

All imports over a certain value must be declared to Italian Customs (Agenzia delle Dogane).

Value-added tax (VAT) is charged on nearly all imports.

Used personal effects may enter tax-free with documentation under the Transfer of Residence program.

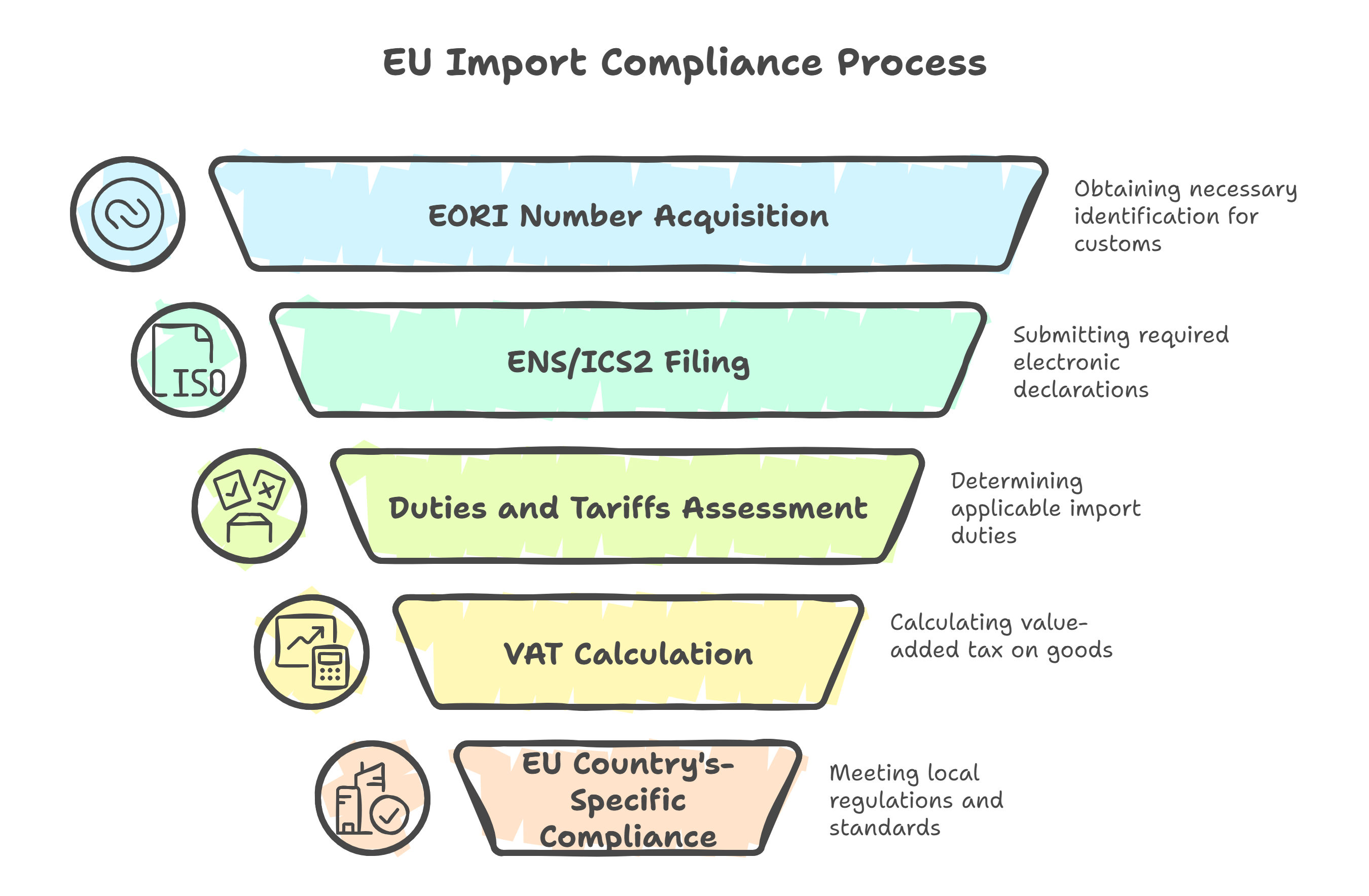

Step-by-Step: How to Import to Italy

1. Get an EORI Number (If Needed)

Anyone importing regularly into Italy must have an EORI number (Economic Operators Registration and Identification).

Businesses based in Italy or the EU: Apply through Agenzia delle Dogane.

U.S. companies without an Italian office typically work with a customs broker or an international shipping company that can act on their behalf.

2. Prepare Required Documents

For all shipments into Italy, prepare the following:

- Commercial invoice or pro forma invoice (for personal effects)

- Packing list

- Bill of Lading or Air Waybill

- Certificate of Origin (optional, may help with duty exemption)

- EORI number (for commercial shipments)

- Power of attorney (if using a broker)

If you're using a qualified international shipping company, they’ll assist with generating and submitting these forms correctly.

3. Declare to Italian Customs & Pay Duties/VAT

Italy utilizes the EU’s TARIC system to determine customs duties. Most items imported from the U.S. will incur:

- Customs duty: Typically between 0% and 12%, depending on the product

- VAT: Standard rate is 22% (applied to CIF value + duty)

You may be eligible for duty relief if you can prove that your goods meet EU preferential origin rules, supported by a Certificate of Origin or invoice declaration.

4. Comply with EU & Italian Product Standards

Consumer products must comply with EU regulations, including:

- CE marking for electronics, toys, medical devices, and machinery

- Labeling in Italian: Required for most consumer-facing products

- REACH or RoHS compliance for chemicals and electronics

Food, cosmetics, and pharmaceuticals must be pre-approved by Italian agencies such as:

- Ministry of Health

- Customs and Monopolies Agency

- ASL (Local Health Authorities)

A reliable international shipping company will help navigate these certifications to avoid border issues.

Shipping Personal Effects from the U.S. to Italy

If you’re shipping household goods or personal items, Italy offers Transfer of Residence (ToR) relief, which exempts qualifying used goods from duty and VAT.

To qualify:

- You must have lived outside the EU for at least 12 months

- The goods must have been owned and used for at least 6 months

- You must move your legal residence to Italy

- Goods must be imported within 12 months of arriving in Italy

Required Documents:

- Passport and Italian residence permit (or visa)

- Inventory list in Italian

- Proof of residence abroad (utility bills, lease)

- Statement that goods are for personal use

Personal shipments are often inspected. Avoid packing:

- Alcohol or tobacco

- Firearms or weapons

- Large quantities of new, unused items

Labeling and Compliance Requirements

Products entering Italy must comply with both EU and Italian consumer protection laws. These include:

- Italian labeling for food, cosmetics, textiles, and appliances

- CE marking, where applicable

- Energy ratings for electrical appliances

Labels must show:

- Product name and type

- Manufacturer’s name and address

- Country of origin

- Warnings or usage instructions in Italian

Failure to comply may result in fines or seizure. A trusted international shipping company can help verify if your products meet these standards.

Who Can Help?

To successfully navigate Italy’s import procedures, consider working with:

- Licensed Italian Customs Brokers or Agents

They can:

- File your import declarations

- Register or use an EORI number on your behalf

- Help apply for VAT relief or exemptions

- Ensure product labeling meets legal requirements

Alternatively, choose a U.S.-based international shipping company that handles Italian customs clearance from start to finish. They can ensure affordable shipping without compliance issues.

Final Import Checklist for Italy

| Requirement | Applies to | Action |

|---|---|---|

| EORI number | Commercial shippers | Apply via Italian Customs (Agenzia delle Dogane) |

| Customs declaration | All shipments | Must be submitted via the EU system |

| Customs duties | Most commercial imports | Based on HS code using EU TARIC rates |

| VAT (22%) | All imports | Applied to CIF + duty; exceptions possible for ToR |

| CE marking / compliance | Regulated products | Electronics, toys, and devices must carry CE and pass safety checks |

| Italian labeling | Consumer products | Food, cosmetics, and more must be labeled in Italian |

| ToR duty relief | Individuals relocating | Available for used household goods with proper documentation |

| Prohibited item screening | All shipments | Avoid banned goods, weapons, and counterfeit products |

Conclusion: Hassle-Free Shipping to Italy

Importing into Italy is straightforward when you understand the requirements. Whether you're shipping from the USA as an individual or a business, following the right steps can minimize clearance time and reduce your total international shipping costs.

For seamless, affordable shipping, it’s best to work with an experienced international shipping company that handles both U.S. export and Italian customs procedures. They can handle documentation, duties, and local delivery, ensuring your shipment arrives without any surprises.

.png)