|

|

Less-than-Container-Load | Affordable International Shipping | 7-Step Guide

Shipping Goods from the USA to Germany

Guide to Import Regulations in Germany and the EU: A Must-Know Resource for U.S. Shippers

If you're involved in international shipping from the USA to Europe, whether you're sending commercial cargo or personal effects, understanding import regulations is crucial to avoiding delays, extra fees, or rejected shipments. This guide explains both European Union–wide import rules and requirements specific to Germany, with a focus on helping people and businesses shipping goods from the USA.

Whether you're working with an international shipping company or handling logistics independently, understanding the rules upfront can help reduce your international shipping costs and inform your decisions regarding customs clearance, duties, VAT, and other compliance requirements.

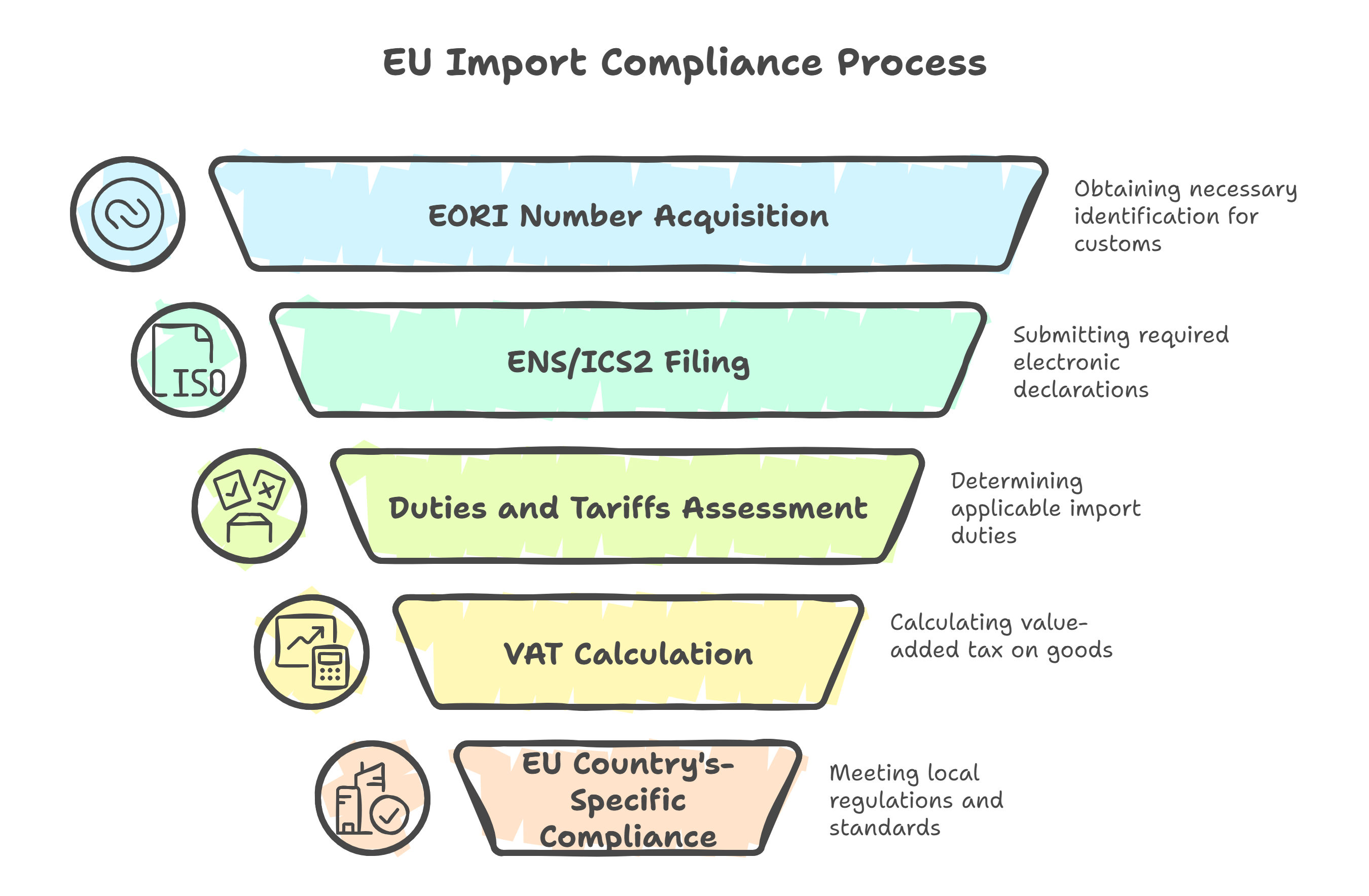

Part 1: EU-Wide Import Regulations (Including Germany)

As a member of the European Union, Germany follows the EU's Union Customs Code (UCC). These regulations apply to all goods entering any EU member state and are especially important when shipping from the United States to Europe.

1. EORI Number

What is it?

- An EORI number (Economic Operators Registration and Identification) is required for all customs-related activities within the EU. It identifies the importer or exporter in the EU system.

Who needs it?

- Any business or individual involved in cross-border trade with the EU, including people shipping personal items from the USA.

Where to get it?

- In Germany, EORI numbers are issued by the Generalzolldirektion (Federal Customs Directorate). But any EU country can issue one. If you’re working with an international shipping company, they may assist you with the application process.

2. Entry Summary Declaration (ENS) and ICS2 Filing

Goods entering the EU must be electronically pre-declared using the ENS (Entry Summary Declaration) system. This filing includes information about the shipper, consignee, cargo contents, origin, and routing.

❗ IMPORTANT: Since the introduction of ICS2 (Import Control System 2), additional data is now required before the goods leave the exporting country.

✔ When shipping from the U.S., your international shipping company - ocean freight carrier - may submit this data on your behalf.

Failing to submit ENS/ICS2 can result in cargo holds or rejections at the border, which can increase your overall international shipping cost.

3. Duties and Tariffs (TARIC System)

The EU applies import duties based on product classification using the TARIC system (Integrated Tariff of the European Communities).

- Duties vary depending on the Harmonized System (HS) code for your item.

- Some items are duty-free, while others may incur significant rates.

A knowledgeable international shipping company can help correctly classify your goods, so you don’t overpay duties or under-declare (which can lead to fines).

4. Import VAT (Value-Added Tax)

In addition to customs duties, the EU applies import VAT on almost all goods entering its territory.

- Standard VAT in Germany: 19%

- Reduced rate: 7% (for books, printed matter, some food products)

VAT is calculated on the CIF value (Cost + Insurance + Freight), which means your international shipping cost directly impacts your tax burden.

Working with an international shipping company that understands EU VAT rules can help you save money and ensure that proper documentation is filed.

Part 2: Germany-Specific Import Requirements

Although EU laws apply uniformly, each country has its own national procedures and enforcement practices. Germany is renowned for its meticulous attention to product labeling, safety standards, and environmental compliance.

Here are some of the country-specific regulations that apply to imports arriving in Germany:

1. Local Product Rules and Licensing

Some goods require special clearance or may be subject to import bans or licensing. Examples include:

- Food, agricultural products, and alcohol

- Medical devices and pharmaceuticals

- Toys and consumer electronics

- Chemicals, dual-use items, and certain tools

Many of these require CE marking, and in some cases, additional documentation such as certificates of conformity or lab test results.

Ensure your international shipping company understands product classification, especially for regulated items.

2. German Language Labeling

Products sold or distributed in Germany must typically include instructions, safety warnings, and labels in the German language. This is especially critical for:

- Cosmetics

- Toys

- Electrical appliances

- Food and beverages

Lack of proper labeling may result in customs authorities detaining or rejecting your goods.

Best Practice: Discuss labeling standards with your international shipping company before sending goods to Germany or any other location in the EU.

3. CE Marking for Regulated Products

Many items—especially those related to health, safety, or the environment—must meet EU conformity standards and bear the CE mark.

Examples:

- Electronics

- Toys

- Machinery

- Construction materials

If you’re shipping from the USA, your product may need to be tested or certified before it can be legally sold or distributed in the EU.

4. Packaging and Waste Compliance (Verpackungsgesetz)

Germany enforces strict rules under the Packaging Act (Verpackungsgesetz). If you're sending consumer-packaged goods (i.e., anything sold to end-users), you must:

- Register with the Zentrale Stelle Verpackungsregister (ZSVR)

- Join a dual recycling system (e.g., Der Grüne Punkt)

- Label your packaging properly for sorting and disposal

This applies even if you're shipping just one box of retail goods. It’s a common compliance trap for small exporters.

Many international shipping companies offer guidance or referrals to local compliance agents in Germany.

Shipping Personal Effects from the U.S. to Germany

Not a business? No problem—international shipping from the U.S. also applies to individuals sending household goods, gifts, or personal belongings.

When shipping personal effects, make sure to:

- Provide a detailed inventory list (in English or German)

- Include a change-of-residence certificate (if applying for tax exemption)

- Be aware that ENS filing is still required

- Work with a broker or international shipping company to assist with customs clearance

Personal shipments may still be subject to VAT and duties depending on their value and contents.

Who Can File for You?

Whether you're a private shipper or commercial exporter, you can appoint a customs representative in the EU to act on your behalf.

Use a Licensed Customs Broker or Agent

These professionals can:

- File your EORI application

- Handle ENS / ICS2 submissions

- Classify products under TARIC

- Pay VAT on your behalf

- Ensure compliance with CE marking, packaging laws, and labeling

Many U.S.-based international shipping companies collaborate with trusted European Union (EU) agents, particularly for established trade lanes between the U.S. and Germany.

Final Import Checklist

| Requirement | Applies to | Action |

|---|---|---|

| EORI number | All importers | Apply through any EU member state's customs authority |

| ENS / ICS2 | All incoming shipments | File electronically before cargo arrival |

| Import VAT | Most goods | Calculate based on the CIF value and declare appropriately |

| Duties (via TARIC) | All taxable items | Classify goods accurately and check applicable duty rates |

| CE marking | Regulated products | Ensure product meets EU safety and health conformity standards |

| Labeling (German language) | Consumer goods | Translate safety labels, instructions, and legal markings as required |

| Packaging Act compliance | Retail-ready packaged goods | Register with ZSVR and participate in a certified recycling scheme |

| Licensing / certification | Special categories (e.g., food, electronics, chemicals) | Obtain required import approvals, documents, and certificates |

Conclusion: Ship Smarter, Ship Compliant

Understanding the regulations for shipping from the U.S. to the EU, especially when your destination is Germany, will protect you from delays, penalties, or returned cargo. From filing ENS and obtaining an EORI to managing international shipping costs and VAT, it’s important to partner with a trusted international shipping company that can guide you through the process.

Whether you're a business or an individual, affordable shipping means more than just finding the lowest rate—it means staying compliant, avoiding hidden costs, and ensuring smooth delivery from door to door.

.png)