|

|

Less-than-Container-Load | Affordable International Shipping | 7-Step Guide

Shipping Goods from the USA to France

France Import Regulations: A Complete Guide for U.S. Shippers

France is a major entry point for cargo into the European Union. Whether you're a business exporting goods or an individual shipping from the USA, understanding France’s import rules is essential to avoid delays, high taxes, or non-compliance penalties.

This article provides a practical overview of France’s customs procedures, import documentation, taxes, and labeling requirements. It is especially useful for first-time exporters or individuals relocating to France with household goods. Partnering with an experienced international shipping company can help you simplify the process and reduce your overall international shipping costs.

Key Facts About Importing to France

- France is an EU member, so it adheres to EU customs law and VAT regulations.

- Importers must be registered with an Economic Operator Registration and Identification (EORI) number.

- Most goods incur VAT (20%), plus possible customs duties.

- Certain product categories require CE marking and French labeling.

- Individuals relocating to France may qualify for duty-free entry under the "transfer of residence" rule.

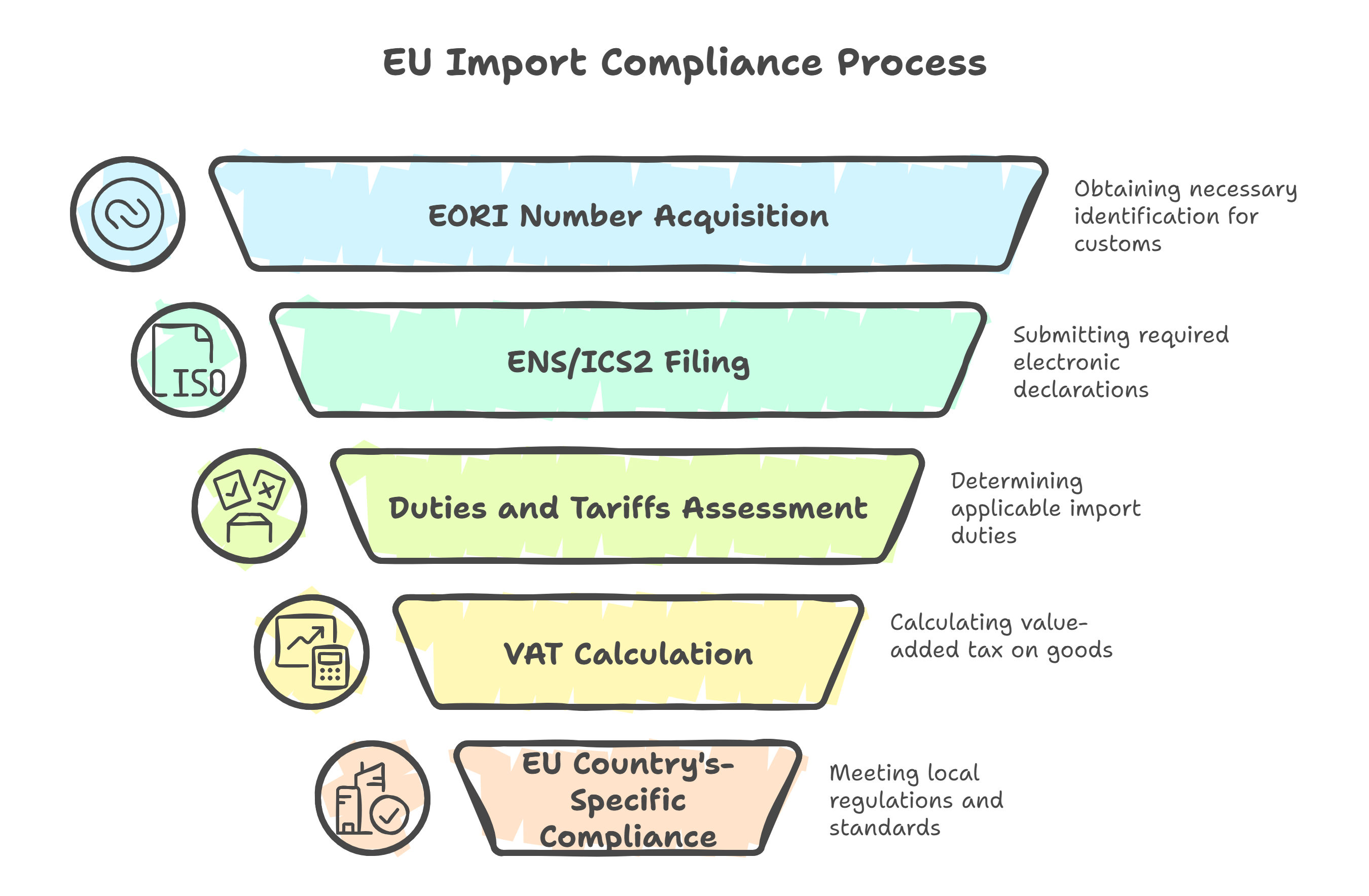

Step-by-Step: How to Import to France

1. Obtain an EORI Number

If you’re importing on a commercial basis, an EORI number (Economic Operators Registration and Identification) is mandatory.

- EU-based companies: Apply through French Customs (Douanes).

- U.S. exporters: Your broker or international shipping company can act as the declarant and use their EORI on your behalf.

2. Prepare Required Documentation

All shipments into France must include the following:

- Commercial invoice (or pro forma for personal goods)

- Packing list

- Bill of Lading or Air Waybill

- Certificate of Origin (optional, can support duty relief)

- Customs declaration (SAD form) via the EU customs system

If you’re shipping used household items, an inventory in French is recommended.

3. Declare to Customs & Pay Duties and VAT

France calculates duties and VAT based on EU rules:

- Customs duty: Depends on the product’s HS code (0%–12% typical)

- VAT: Standard rate is 20%; applied to CIF value plus duty

If your goods qualify for preferential origin status, you may be eligible for reduced or zero customs duties, provided you have the proper documentation.

Your international shipping company or broker will typically handle all tax payments on your behalf.

4. Comply with French & EU Product Regulations

Imported goods must meet both EU and French standards, including:

- CE marking for electronics, toys, and machinery

- French labeling for food, cosmetics, clothing, and household items

- REACH and RoHS compliance for chemicals and electronics

French authorities are strict with product compliance. Always verify requirements before shipping. A knowledgeable international shipping company can assist with certifications and packaging checks.

Shipping Personal Effects from the U.S. to France

If you’re moving to France, you may be eligible for duty and VAT exemption under the Transfer of Residence (ToR) allowance.

To Qualify:

- You lived outside the EU for at least 12 consecutive months

- Items must be used, not new

- You must import them within 12 months of your arrival in France

- You cannot sell or transfer the goods for 12 months after import

Documents Required:

- Passport and French residence visa or permit

- French-language inventory list

- Proof of residence abroad (e.g., lease, utility bills)

- Declaration of transfer of residence (Cerfa form)

Avoid packing:

- New or unused items

- Restricted goods (weapons, medicines, alcohol, tobacco)

- Counterfeit items or undeclared high-value goods

French Labeling and Consumer Standards

France requires that imported consumer goods be labeled in French. This applies to:

- Food and beverages

- Clothing and textiles

- Household appliances

- Cosmetics and personal care products

Common labeling requirements include:

- Product name and usage instructions

- Ingredients or materials

- Country of origin

- Manufacturer’s contact information

Failure to comply can lead to cargo seizure, fines, or rejection at the border.

Your international shipping company can help ensure your products meet these standards before departure from the U.S.

Who Can Help You?

- Working with the right partner is critical for success in French customs clearance.

Use a Licensed French Customs Broker or Shipping Company

They can:

- File all customs entries and declarations

- Coordinate with the Douanes and port authorities

- Pay duties and VAT on your behalf

- Guide you through CE and labeling compliance

Or partner with a U.S.-based international shipping company experienced in EU imports. This ensures affordable shipping, proper documentation, and reliable cargo handling from origin to destination.

Final Import Checklist for France

| ✅ Requirement | Applies to | Action |

|---|---|---|

| EORI number | Commercial importers | Required to file customs entries |

| Customs declaration | All shipments | Submit through the EU’s electronic system |

| Customs duties | Most goods | Based on TARIC classification |

| VAT (20%) | All imports | Paid on CIF value + duty; exceptions for ToR eligible shipments |

| CE marking | Regulated goods | Electronics, machinery, toys, and other items. |

| French labeling | Consumer products | Food, cosmetics, textiles, and more |

| Transfer of Residence (ToR) | Personal imports | Allows duty-free entry of used items with proof |

| Certificate of Origin | U.S.-made goods | Can support duty reduction under trade agreements |

Conclusion: Shipping to France Made Simple

Importing to France from the U.S. is smooth when you follow EU rules and prepare proper documentation. Whether you’re sending commercial products or personal effects, understanding duties, VAT, and labeling laws can save you time, money, and hassle.

To control your international shipping costs, it's best to work with a reliable international shipping company. They can manage customs filings, help you meet French import standards, and ensure affordable shipping with door-to-door service.

.png)