Freight from the USA

|

|

|

|||

Less-than-Container-Load | Affordable International Shipping | 7-Step Guide

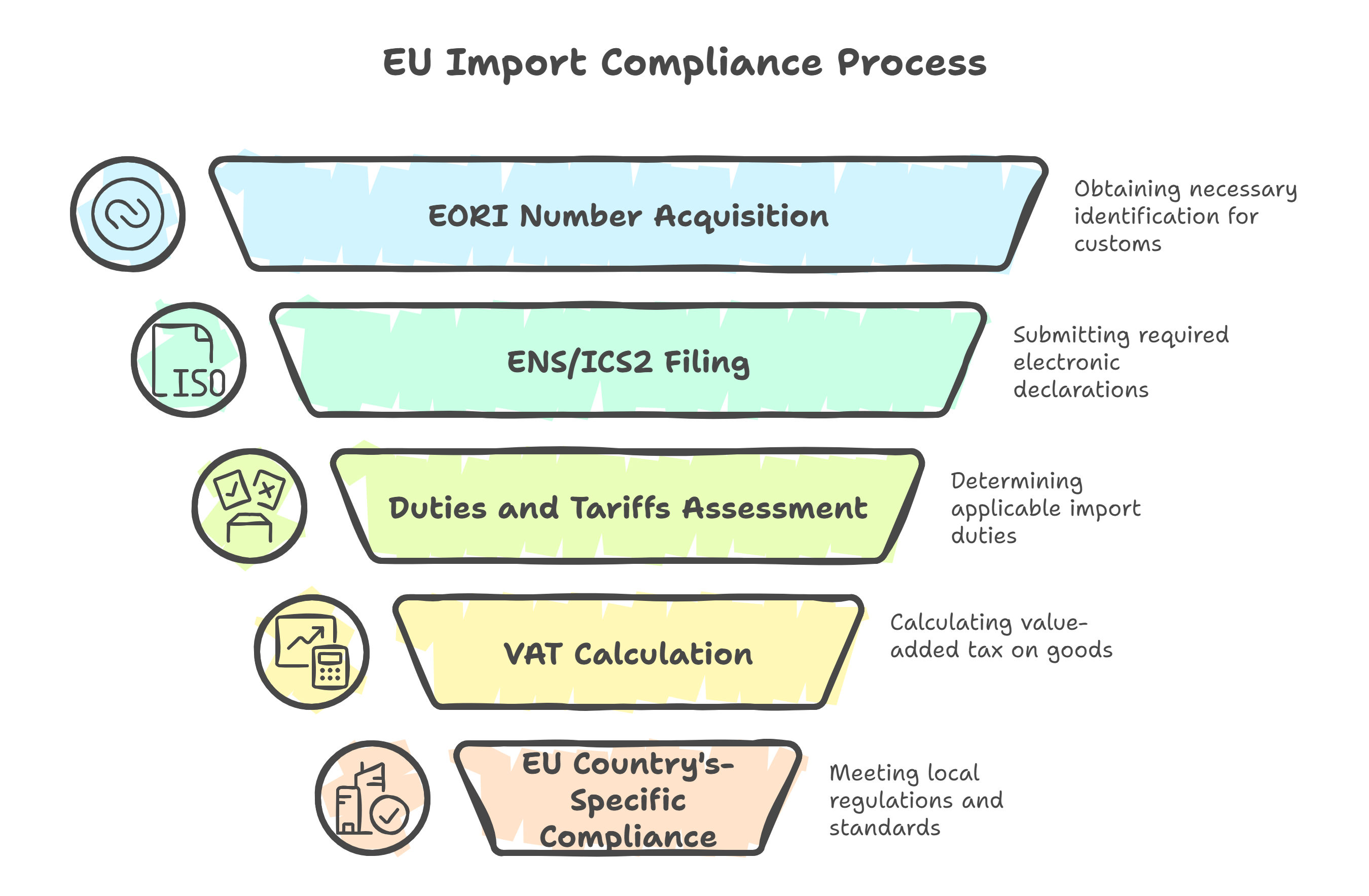

Ireland is a friendly and accessible destination for both U.S. commercial exports and personal shipments. As a member of the European Union (EU), Ireland adheres to EU customs law, which means shipments are subject to standard EU import rules, including VAT, customs duties, and compliance requirements.

This guide explains how to successfully navigate the Irish import process, manage taxes and paperwork, and reduce international shipping costs with the support of a trusted international shipping company.

Ireland follows the EU Union Customs Code (UCC).

An experienced international shipping company can help ensure compliance, avoid delays, and manage affordable shipping options from the USA.

Every commercial import into Ireland must be handled by a party with a valid EORI number (Economic Operators Registration and Identification). For personal shipments, customs clearance is typically handled by a customs broker or your international shipping company.

Customs clearance through the Irish Revenue’s Automated Import System (AIS) requires:

Personal shipments require:

Ireland applies the following charges on imports:

Taxes are assessed based on the CIF value (Cost, Insurance, and Freight). Your international shipping company can help estimate the total international shipping cost and applicable taxes before your shipment is sent.

Goods shipped to Ireland must meet EU safety, labeling, and technical compliance standards:

Labeling must include:

Incorrect or missing labels may result in delayed clearance or fines.

If you are moving to Ireland, you may be eligible for duty- and VAT-free importation of used personal effects.

To Qualify:

Required Documents:

Retail goods shipped to Ireland must comply with EU labeling laws, including:

All wooden packaging must comply with ISPM 15 standards (heat-treated and stamped). Non-compliant wood may be destroyed or quarantined.

Use a Licensed Irish Customs Broker or International Shipping Partner

A licensed broker or your international shipping company can:

For most U.S. shippers, a full-service international shipping company is the easiest and most cost-effective option for managing customs and delivery in Ireland.

Final Import Checklist for Ireland

| ✅ Requirement | Applies to | Action |

|---|---|---|

| EORI number | All commercial imports | Must be obtained before import |

| Customs declaration (AIS) | All goods | Filed electronically by broker |

| Customs duty | Based on product category | Usually 0–10% |

| VAT (23%) | All goods | Based on CIF + duty value |

| Excise tax | Alcohol, tobacco, etc. | Additional rates may apply |

| EU compliance (CE, RoHS, etc.) | Regulated goods | Products must meet safety/labelling standards |

| ISPM 15 wood packaging | Pallets, crates, dunnage | Required for untreated wood |

| Transfer of residence | Personal effects | C&E 1076 form and relocation proof needed |

Shipping to Ireland is straightforward with the right planning and support. As part of the EU, Irish customs follow standardized rules, but you’ll still need to comply with specific tax rates, documentation, and product standards.

By partnering with a reputable international shipping company, you can reduce stress, lower your international shipping costs, and enjoy affordable shipping solutions for both commercial and personal imports.

|

|