Freight from the USA

|

|

|

|||

Less-than-Container-Load | Affordable International Shipping | 7-Step Guide

Portugal, a key gateway to the European Union, is a popular destination for both personal and commercial imports from the United States. Whether you're shipping household goods, commercial cargo, or online orders, adhering to Portuguese and EU import regulations is essential.

This guide outlines the steps to prepare for shipping from the United States to Portugal, including customs procedures, taxes, and required documentation. You'll also learn how an experienced international shipping company can help reduce your international shipping costs and ensure affordable shipping. Key Facts About Importing to Portugal

Portugal adheres to European Union customs rules and is part of the European Union's Single Market.

Imports are handled by Portuguese Customs (Autoridade Tributária e Aduaneira).

All goods arriving from outside the EU are subject to customs clearance, duties, and VAT (23%).

Personal effects may be imported duty-free under specific conditions.

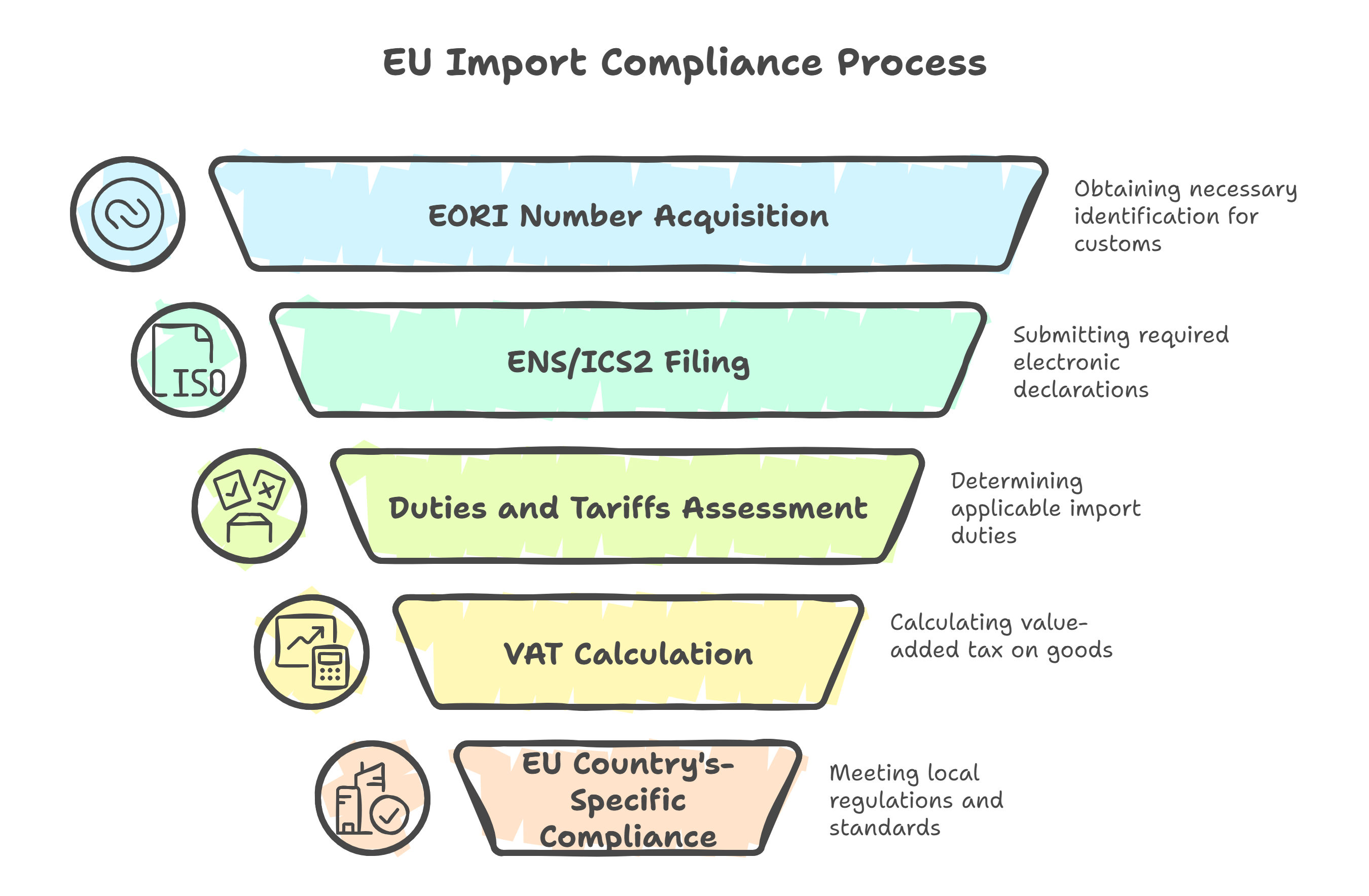

EORI registration is required for commercial shipments.

An experienced international shipping company can ensure your shipment complies with EU standards and help you estimate your total international shipping cost before dispatch.

If you’re a business shipping goods into the EU, you’ll need an Economic Operator Registration and Identification (EORI) number issued by any EU member state.

For both personal and commercial shipments, you’ll need:

For personal effects:

Consistent values and descriptions are critical to avoid clearance issues.

Imported goods from the U.S. are subject to:

Personal effects may qualify for duty and VAT exemption if:

A qualified international shipping company can help you calculate the full international shipping cost, including all taxes and exemptions.

Portugal adheres to EU regulations regarding prohibited and restricted items. These include:

Labeling Requirements:

Wood packaging must comply with ISPM 15 regulations and be properly marked or stamped.

If you're relocating to Portugal, you may bring used personal belongings and household goods duty-free.

To Qualify for Tax-Free Entry:

Required Documents:

New items or large quantities may be subject to full import taxes.

Consumer goods shipped into Portugal must follow EU standards:

Wooden crates and pallets must be ISPM 15 compliant (heat-treated and stamped). Non-compliant wood may be refused entry.

Use a Licensed Customs Broker or International Shipping Company

A licensed customs broker or full-service international shipping company can:

Partnering with experts helps you avoid fines, delays, and hidden fees while ensuring affordable shipping from the U.S.

Final Import Checklist for Portugal

| ✅ Requirement | Applies to | Action |

|---|---|---|

| EORI number | Commercial shipments | Register before customs entry |

| Customs declaration (SAD) | All goods | Required for customs clearance |

| Customs duties | Most imports | Based on EU tariff schedules |

| VAT (23%) | All goods | Calculated on CIF + duties |

| Labeling in Portuguese | Retail products | Mandatory for clearance |

| ISPM 15 packaging | Wood materials | Required for pallets and crates |

| Personal documents | Household moves | Required to qualify for tax exemption |

Portugal’s EU membership means well-defined customs rules, but that also requires close attention to detail. Whether you’re sending goods for business or relocating your home, documentation, labeling, and taxes must be handled carefully.

An experienced international shipping company can reduce your international shipping cost, guide you through customs, and deliver a seamless, affordable shipping experience from the USA to Portugal.

|

|